4 Mistakes To Avoid When Creating Your Will

Written by: Marc Ashton Save to Instapaper

Author: Stella Pickard, CEO Quickwill

Cape Town – For most of us, even the thought of creating a Will is tedious and somewhat grim. It’s forgivable (who wants to think about dying?), yet a Will is a critical financial planning tool that has major consequences for your family and loved ones. Sadly, many people either ignore the question of a Will or go about it in a half-hearted way – which can lead to costly mistakes that harm the financial and emotional wellbeing of loved ones. The good news is that such mistakes can be easily avoided – simply by being aware of the pitfalls around creating a Will.

Let’s take a closer look…

1 – You ignore a Will entirely This is unfortunately the biggest and most common mistake. Research has shown that more than 70% of South Africans pass on without a Will. The technical term for this is to die ‘intestate’ – which most often leaves the surviving family and loved ones with huge amounts of legal and administrative work, at a time when they are most wanting to be left alone to grieve and heal. The lesson here? Do not ignore your Will, and look for tools, platforms and professionals who can help you with the process.

2 – You appoint a friend or family member as the Executor The appointment of an executor is one of the most critical elements of your Will. Yet many people don’t give this careful thought and often appoint close friends or family members to the role. This is a risky practice, primarily because personal relationships change over time and that person may not be the most suitable when the time comes. At Quickwill, we believe best practice is to assign the role to a professional executor or someone with extensive legal or financial experience (and who is somewhat removed from the family) and then assign this person the right of assumption. This route gives the executor the right to appoint an experienced lawyer, who can negotiate a fair and efficient outcome for the heirs fee for the administration of the estate.

3 – You include assets in another country When crafting your Will, it is important to remember that if you include assets that are located abroad, this could significantly delay the execution of the Will. To avoid any lengthy delays, rather look to craft a separate Will for assets that are located abroad – keeping in mind that an executor cannot administer an estate and handle assets in a different country until your estate is settled in South Africa. If you have a separate Will for each country, then the process of executing each Will can take place simultaneously (thus eliminating any unnecessary delays).

4 – You make changes that nullify/invalidate the Will All too often, small mistakes are made with Wills that render them legally inadequate – which again can lead to huge heartache and administrative strain for loved ones. For example, people often fail to get all the required signatures and witnesses that are needed to ratify the document. Another common mistake is to make handwritten changes or updates to your Will, which can also nullify the document cause complications from a legal perspective.

To avoid these costly mistakes, we recommend that you look for online and automated solutions that allow you to easily manage and update your Will online – with professional help to make sure that the right steps are followed. Critically, such a platform will empower you to keep your Will updated along with the major financial and personal events that inevitably unfold. There is no doubt that crafting a rigorous and legally binding Will is one of the most important aspects of financial wellbeing for South African families.

To get it right, make sure to educate yourself around the importance of creating a Will, and seek professional help to ensure that you follow the correct processes. At Quickwill, we believe that everyone has the right to a professional, affordable Will – so make sure that you harness all the tools available to you!

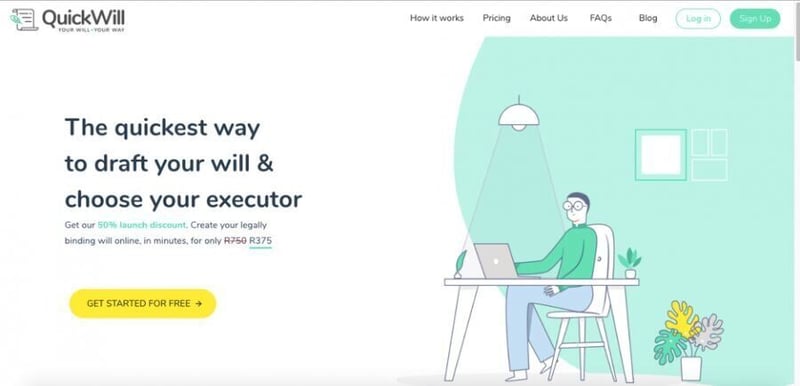

Quickwill is a South African financial and legal technology business which aims to improve access to Justice of ordinary South Africans. The technology allows you to draft your Will online, appoint an Executor and lodge it for safe-keeping. For more information, please visit www.quickwill.co.za

Get new press articles by email

Part of the Decusatio Group of Companies and founded by award-winning financial journalist Marc Ashton, Decusatio Investor Relations and Communications is a specialist B2B communications partner

Latest from

- Virtual Power Plants - AI at the heart of Africa’s energy resilience

- Summit to Drive Urgent Action and Investment to Scale up Renewable Energy Access Across Africa Ahead of the G20

- OPINION - The importance of data to enhance South Africa’s SME Ecosystem

- SME Snapshot launches enhanced platform to help South African SMEs access funding and grow

- Ariston’s Suran Moodley Named Best Lead HR Auditor by SABPP

- B-BBEE in 2025 - What South African businesses must know

- Ariston Global and Xero Host Event to Equip Accountants and Drive Small Business Growth in South Africa

- From Hunger to Hope - Alfeco Foundation serves 1.5million meals, eyes 50,000 learners by 2026

- The future of forecourt logistics is here

- Celebrate International Women’s Day with Bollywood film Pink (2016) at the Indian Film Festival South Africa

- Vector Logistics launches first fully electric net-zero trucks

- South Africans Encouraged to Shape Kidney Cancer Care - Global Patient Survey Now Open

- Payflex introduces "Pay in 3" - a new payment option to best suit South African consumers

- Campaigning for Cancer calls for local participation in Lymphoma Coalition's Global Patient Survey 2024

- Supplier Development partnership delivers access to solar energy for the most vulnerable

The Pulse Latest Articles

- Education Is The Frontline Of Inequality, Business Must Show Up (December 11, 2025)

- When The Purple Profile Pictures Fade, The Real Work Begins (December 11, 2025)

- Dear Santa, Please Skip The Socks This Year (December 10, 2025)

- Brandtech+ Has 100 Global Creative Roles For South African Talent (December 9, 2025)

- The Woman Behind Bertie: Michelle’s Journey To Cape Town’s Beloved Mobile Café (December 9, 2025)