Cashless Payment innovations in South Africa globally competitive

JOHANNESBURG-South African businesses need to capitalize on the potential that exists in bio-metric enabled cashless transactions as they can now embed Software Development Kits, SDKs, into their own apps to biometrically enable the apps to validate identities while a customer is registering, logging on or processing a cashless transaction. Business Development Director for local bio-metric authentication specialists, Fides Cloud Technologies, Craig Hills says, “the major barrier to the adoption of bio-metrics for retail and other transactional activities in the last decade has been the need for additional hardware to verify identities but with modern SDK’s, that can be a thing of the past.”

Hills, who will be speaking on the subject of Bio-metrics in the cashless system and future possibilities at the 2019 Cashless Payments Summit taking place at Emperors Palace in Johannesburg on the 7th and 8th of November, added that the introduction of relatively cheap smartphones with cameras which have sufficient quality to capture a bio-metric image, has allowed for bio-metrics to be included in any customer engagement strategies both in branch and remotely at retail shops.

Still on how retail service providers can benefit from modern cashless payment systems which are constantly innovating, innovative bitcoin company Centbee CEO, Angus Brown, said “retailers and other businesses need to take advantage of the fact that South Africans are in the top five global adopters of cryptocurrency.”

Looking at how some retailers, especially smaller one’s view cryptocurrencies, Brown said, ‘They do not need to understand how cryptocurrencies work – they just need a Bitcoin Payment Processor, which acts like an acquiring bank to handle all this for them”.

Brown, who will also be speaking at the 2019 Cashless Payments Summit said paying by scanning a QR code is becoming ubiquitous and in some countries is now the de-facto payment type while BitcoinSV is currently processing at the speed of thousands of transactions per second, and provides instant confirmation – completely suitable as a payments clearing and settlement network.

This year, the Cashless Payments Summit, being organized by Vukani Communications will also feature speakers like Farieda Mayet from Huawei who will showcase new developments in technological infrastructure that enable a successful digital economy, Brett Williams from Zapper will be evaluating how and why banks and retailers need to collaborate in the cashless system. Arthur Matsaudza from stock exchange listed digital solutions giant, Cassava Smartech, which owns Ecocash will be looking at the constant race to innovate, deliver and thrive despite a myriad of operational challenges in the cashless sphere while Reneitte Van der Merwe from ABSA, will be talking about cashless payments in the informal economy. Tracey Sibanda for Vukani Communications

FOUNDATION FOR CHILDREN WITH HEARING LOSS IN SA RECEIVES R189 093.01 AT GOLF DAY

Gauteng, South Africa – On Thursday, 15 November Forever Resorts South Africa hosted their annual Charity Golf Day, this year in aid of the Foundation for Children with Hearing Loss in SA at Blue Valley Golf and Country Estate.

The Foundation aims to improve the quality of life for people with hearing loss, creating a sustainable future for people with hearing loss, inspire, educate, develop and empower an entire community, create fresh perspectives and innovative solutions, promote social welfare, encourage poverty alleviation and generate a lasting change.

The Forever Golf Day raised a total of R189 093.01 and the funds were paid over directly to the foundation to help three children (Haley Smit (4 years), Ronisha Malander (4 years) and Mulweli Makhuva (9 years)) with funds to pay for their cochlear implants. Mulweli underwent his operation on Monday, 19 November 2018 and will now be going through the process of slowly training his brain to hear again as he lost his hearing due to illness some years ago.

“On behalf of Forever Resorts we would like to thank our wonderful sponsors who participated in our annual Golf Day, without you, your passion and your selfless generosity this would not have been possible. Oranje Drukkers, Bravo Group Sealy, Backgat Braai, Adams&Adams, Pam Golding Nelspruit, Beeld, Birchwood Hotel, Unlimited Events Group, Forever Warmbaths, Forever Badplaas, Forever Gariep, Forever Centurion, Forever Loskopdam, Forever White River, BDT Accountants, AirlinkVictoria Falls Rainbow Hotel, Wild Horizons Tours, The Good Oaks, Pentagon Security Consultants, FNB, Valorem, Agri SA, Rockwood Theatre, Delheim Wines, Levati Water, Rhino Clothing, Work Front, Dairymaid, Pretoria FM, Decimal Agency and Zebula Golf Estate and Spa”, said Heidi Halgryn, Marketing Executive at Forever Resorts South Africa.

Post SA Investment Conference, AfricArena, Wesgro and Silicon Cape Presents Deep-Dive into Tech Investment in Africa - African tech startups represents less than $50c per capita

AfricArena, Silicon Cape and Wesgro host expert discussion and release research indicating funding raised by African startups to increase by 100%+, exceeding $1 billion for the first time.

Tuesday, 30 October, Cape Town – In the wake of the SA Investment Conference that took place last week, AfricArena, Wesgro and Silicon Cape hosted a press conference at the InvestSA One Stop Shop in Cape Town, making public new partnerships for the conference and discussing the role conferences and accelerators like AfricArena play in attracting investment to the continent.

Partech Ventures’ latest annual funding report shows that venture capital funding in 2017 reached $560 million, recording 53% year on year growth. South Africa, Kenya and Nigeria dominate with 6% of total funding. Francophone Africa is accelerating with 14% of the deal transactions and financial inclusion (off-grid tech, fintech and insuretech) representing 45% of deals.

The track record shows the trend is that African tech entrepreneurs are raising more and more funding. Yet, the amount of investment going to African tech startups represents less than $50c per capita whilst in Europe the investment is $50 per capita in the USA $150. Currently, less than 1% of global tech investment is into Africa whereas on the global scene, in 2017 the USA attracted $74 billion, Asia $71 billion and Europe nearly $18 billion.

“If we are to create the next generation of successful entrepreneurs competing at a global scale – clearly the challenge remains as an input and output measure to increase the level of capita that African startups attract,” states Christophe Viarnaud, CEO of AfricArena and Methys. ““It is predicted that in 2050 and 2100, there will be more than 50 cities with more than one million people on the African continent, and the majority of the most highly populated cities in the world will be in Africa. This is a very important factor in terms of being a fundamental underlying trend which is going to drive increasing investment in Africa, therefore we foresee the investment in African tech startups to exceed the $10 billion annual mark in the next decade.”

Based on internal research conducted in 2018, AfricArena, Silicon Cape and Wesgro expect the funding raised by African startups to increase by 100%+, exceeding $1 billion for the first time and achieve $1 dollar per capita, positioning Africa as the fastest growing area in the world.

“Another interesting thing is the emphasis we put on taking our startups to the bigger stages outside of the continent,” adds Danai Musandu, Investment Associate, Goodwell Investments BV, “You always find more people rushing to go to Silicon Valley to go see where the big stage and the content is. But we need to have a change of perspective and a change of attitude, where people will say ‘We’re going to Africa, where the big stage of the future is’. The biggest barrier is our perspective and we need to change that perspective.”

AfricArena is a pan-African ecosystem accelerator whose mission is to help African startups access market and capital. The primary outcome measure is investment deals done around the event.

AfricArena 2018 Announcements

Over 70 start ups from over 30 countries will attend, competing in 11 open innovation challenges

In partnership with We Think Code, AfricArena will run a hackathon on a mobility challenge for the City of Cape Town

EM Lyon, a world-ranked business school, joins as academic partner and will stream AfricArena live on its Casablanca, Lyon and Singapore campuses

Over 100 investors from US, Europe, Africa will attend or follow on the live streaming of the pitch sessionsAfricArena announced partnership with Deep Tech platform ‘Hello Tomorrow’ and a Deep Tech Africa challenge that will take place on Day 2 of AfricArena.

Silicon Cape members to receive early bird special of 50% off AfricArena tickets

EM Lyon is an international business school priding themselves in “making entrepreneurs for Africa”. They capitalize on the worldwide-recognized experience and quality of their programs and offer both students and corporations content that is tailored to their context and to their problems. EM Lyon is fully in line with their signature "early maker": a school that tries, investigates and innovates far ahead of others.

Hello Tomorrow organises mentorship programs and a series of events around the world, as well as educating and consulting relevant stakeholders on emergence of deep technologies with the platform fast becoming a key reference in deeptech innovation and entrepreneurship.

Sarah Pedroza, Managing Director of Hello Tomorrow, states: “Deeptech innovation happening today knows no borders. But the opportunities and resources to catalyze these solutions are unevenly distributed. We need to give better tools to deeptech entrepreneurs in ecosystems that are booming, connecting them to a global network of industry leaders, investors and policy makers in order to bring their concepts to market. We’re excited to partner with AfricArena, joining their flagship event in one of the biggest tech hubs in Africa, which is a great opportunity to bring key stakeholders together.”

Finalists for the internationally sponsored challenges were also announced:

VINCE ENERGIES CHALLENGE – How to make energy more accessible in Africa thanks to energy efficiency solutions, energy flows optimization blockchain and/or AI - Rensource (Nigeria), BIG POT – Nigeria, Oniriq – Senegal

SAINT-GOBAIN CHALLENGE – A solution to upgrade professionals’ skills across Africa - Syafunda (South Africa), The Student Hub (South Africa), Ceed Learning (South Africa)

VIVATECH CHALLENGE – How AI can help generate a self-sustaining growth in the AgriTech industry - Agrocenta (Kenya), Homefarm (South Africa), Aerobotics (South Africa)AfricArena will take place on 15 & 16 November.

More information available at www.africarena2018.com

-- ENDS --

For more information on AfricArena or this press release, please contact:

Mika Stanvliet | This email address is being protected from spambots. You need JavaScript enabled to view it. | 081 534 6237

About AfricArena:

Celebrated as the largest tech ecosystem accelerator on the African continent, last year’s edition of AfricArena saw more than 80 startups presenting to over 100 investors with 25 countries being represented and over $2M worth of deals done. The conference serves as a platform for the continent’s best startups and innovators to showcase their world-class talent in front of an audience of both local and international investors. AfricArena is the ultimate deal-flow platform, bringing investors and startups together in one central location.

The challenges run by AfricArena are sponsored by Vinci Energies, AirFrance, Engie, Sanofi, Leroy Merlin, the City of Cape Town and RCS.

The conference is anchored and endorsed by corporate sponsors and partners La French Tech, Silicon Cape, Wesgro, SEDA, and will be covered by several media such as Techcrunch, Les Echos, Maddyness, Fast Company and many others.

We’re asking South Africans: What would YOU do with R1 million?

This Big September, LottoStar, in collaboration with Joburg’s biggest radio station 947, is giving one lucky South African the chance to decide what they would do with one million Rand. That’s right – we’re giving away R1 million to one lucky winner with the How Lucky Can You Get competition. It gets better: as a way of paying it forward and recognizing those who go above and beyond for others, we’re also giving non-profit organisation (NGO) The Grace Factory R1 million.

So far, members from LottoStar, 947, The Grace Factory and the public have made up 2 000 packs and we’ve delivered about 500 packs to six hospitals around Gauteng.

Who is The Grace Factory?

This NGO’s amazing work includes supporting children’s homes by providing them with basic necessities such as clothes, blankets, nappies, baby formula, and other toiletries. Founded in 2013 by Amy Westerman, who currently works full time in a corporate firm as a Chartered Accountant, Alison Wright works at the organisation full time and spends her days collecting clothes, dropping off and following up on donations. “Words cannot express how grateful The Grace Factory is for this life changing donation,” says Westerman. “What started out like any old Monday, was one of the biggest day's in The Grace Factory's history. The R1 million is more than we ever could've imagined and we can help more people with this money than our wildest imaginations could've ever dreamed. Thanks to Lottostar and 947 we can change the lives of so many vulnerable moms and babies. The community of JHB (and now PE, Cape Town and even Welkom) has been so very receptive towards what we are trying to achieve. We have had so many volunteers offer of their time and baby donations and we would like to thank each and every one of them. Together we CAN (and will) make a difference in South Africa."

The How Lucky Can You Get competition

Entering is extremely easy: head over to 947.lottostar.co.za and predict 7 numbers. As a registered LottoStar player, the winner will receive R1 million and a non-registered player will receive R500 000. The winner will be announced during a live outside broadcast with 947’s Breakfast Xpress team on the 3rd of October. Those who try their luck will essentially be playing on one of LottoStar’s most played games, the SuperEnaLotto. Played all over the world, this Italy based game started in the 1950’s, and draws take place on Tuesdays, Thursday and Saturdays at 21h00 (GMT+2) in Rome. Those betting on the SuperEnaLotto choose a total of six numbers out of 90 and a bonus ‘SuperStar’ number. If the chosen numbers match the numbers that are drawn – or a combination of them - the player will place in one of the game’s total of 14 prize tiers.

About LottoStar Licensed and regulated in South Africa by the Mpumalanga Gambling Board, LottoStar is the first website of its kind to ever be launched in the country for the South African market. Offering up incredible potential winnings which have never been seen before in South Africa by allowing players to bet on the results of a hand-picked selection of spectacular international lottery games. You decide the potential of your winnings with the exciting boost function and you get to decide when you want to play, and how you'd like to play. www.lottostar.co.za

For more information / interviews, please contact Maria Pavli on This email address is being protected from spambots. You need JavaScript enabled to view it. / 076 411 5610. The Grace Factory: Amy Westerman on 082 925 5557 / This email address is being protected from spambots. You need JavaScript enabled to view it. / This email address is being protected from spambots. You need JavaScript enabled to view it.

Is South Africa Worthy of Your Investment?

Developing countries like South Africa need FDI (Foreign direct investment). They are investments in a business by an investor from another country for which the foreign investor has control over the company purchased. The Organization of Economic Cooperation and Development (OECD) defines control as owning 10% or more of the business. Increased FDI in developing countries contributes to the country’s economic development because of external capital and increased revenue. This helps developing countries create employment opportunities for its citizens and invest in local skills development and new local industries.

The developing government is able to use the capital infusion and tax revenue generated from FDI for economic growth by improving the physical and economic infrastructure of the country. These include building roads, educational institutions, developing transport and communication systems and also subsidising the creation of domestic industries. The result is making it possible for all citizens to benefit from the FDI. Besides from the monetary aspect; FDI affords developing countries a learning experience which in turn leads to additional growth paths.

South Africa is currently losing Barclays bank, which owns Absa bank; as an investor. Major newspapers are reporting that the country’s wealthiest individuals are taking their money out of the country because they are weary of the country’s economic future. To top things up, according to the latest World Investment Report 2016 FDI into South Africa is sitting at $1.8 billion, the lowest in 10 years, owing to factors such as lacklustre economic performance, lower commodity prices and higher electricity costs.

Policy uncertainty by the government has a major part to play in the economic misfortune and lack of foreign investment confidence from Western industrialised countries which happen to be the country’s major source of FDI. South African households are extremely indebted while the government is short of funding both resulting in limited investment and domestic consumer growth. The future will only start looking brighter for South Africans once the country improves on domestic investments in the form of foreign direct investment.

According to risk analysts, South Africa has risk factors which prevent it from being a lucrative investment market which include the prevalence of white-collar crime and corruption and the increasingly inevitable outcome that South African bonds will be downgraded to “junk” status. Not to mention that South Africa is Africa’s most targeted region for cybercrime. Risk analysts also conclude that South Africa is still a good place to do business. There is plenty of slow and steady money to be made in the country. South Africa’s fundamentals are not as bad as they seem. If you are confident South Africa is worthy of your investment, click HERE for investment insights.

Newly launched range of structured products aimed at retail investors

Varying degree of capital protection, reduced risk and volatility, tax efficiency; minimum investment of R10,000 assures widespread access in investment community

Johannesburg, March 2, 2015: South Africa’s investors will now have far greater access to the asset diversification and protection attributes of structured investment products through the launch of the iStructure product line, which offers innovative structured products designed by four local and international banks.

Available through a countrywide network of financial advisers, iStructure will enable retail investors to invest in market-linked, pre-packaged, fixed-term investment products that provide varying degrees of capital protection, the potential to earn positive returns in most market conditions, tax efficiencies and reduced risk and volatility.

iStructure has been launched by iTransact, the country’s only index product investment platform for financial advisors, which is a leader in the distribution of exchange traded funds and listed notes, portfolios and retirement annuities. iTransact is part of Automated Outsourcing Services (AOS), one of the country’s largest independent administrators of units trusts, ETFs, ETNs, hedge funds and structured products.

Barclays Africa, Investec and international banks Societe Generale and BNP Paribas have put together the structured products that will be available to investors through lump-sum investments of as little as R10,000.

“We want to give retail clients exposure to structured products through different types of wrapper that are suitable to their investment objectives and financial capacities,” said Lance Solms, the head of iTransact, stressing that globally, structured products are recognized as an important component of a well-diversified investment strategy, offering opportunities that traditional investments, such as unit trusts, cannot offer.

“By commoditising structured products, we have made these innovative and flexible investment solutions available to retail investors. This is really bringing the tools used in a modern portfolio within the reach of the ordinary investor. ”

iStructure products only available through investment advisers; aiming for R1 billion a year take-up by investors

Financial advisors will also ensure that the products are suitable for investors.

According to Solms, it is hoped that uptake of the products will exceed R1 billion year within the next year as investors recognise the variety and value they add to the investment options available in the market.

Initially, the structured products being offered by the four banks will be linked to the performance of the well known indices or stocks, such as the FSTE/JSE, Top 40 Index or Apple Inc, but there are plans to diversify further at a later stage.

Most of the products will be for investment terms of five years, although some will have shorter terms. Fee transparency is an important feature of the new products, with all fees being decided upfront and the remaining funds being fully invested.

“With local and international share markets performing strongly over the past few years, these products can enable investors who have made good profits to protect their gains and retain exposure to the markets,” said Solms. “Structured products are designed to work for investors in most market conditions, with capital protection being an important factor. We are targeting investors who don’t need their investment for five years, allowing the structured product investment strategy to work for them.”

Barclays Africa, Investec, Societe Generale and BNP Paribas see strong potential for structured products to gain attraction among South Africa’s retail investors.

“We are very excited to partner with ITransact as a provider of an investment product for their retail network through a life insurance wrapper,” says Haris Contaroudas, Managing Director at Societe Generale Corporate & Investment Banking. “Smart Trend is a capital guaranteed momentum strategy aimed at investors who expect the JSE Top 40 index to rise over the next five years, while being protected against downward trends.“

“The launch of a dedicated multi- issuer structured product platform is an important first for the South African market and is just another milestone in ensuring that investors and advisers ultimately have a wider choice from which to choose when making their vital asset allocation calls,” said Ryan Sydow, Head of Retail, Structured and Risk Solutions at Barclays Africa.

“Structured products are under utilised in the South African retail market compared to their European and US counterparts, yet their attributes lend themselves to being a well suited vehicle to use in the unsophisticated retail arena (for example explicit capital protection). Even the fixed terms nature of the products can be seen as positive (not a view shared by many detractors who see the terms as barrier to investing), given it stops investors, especially those with low market composure, from not staying the course.

We look forward to being a participant and product provider on iStructure and look at the opportunity, not only to have investors support our product, but also to educating investors and advisers alike as we interact with them via this platform, Sydow concluded.”

According to Investec’s Brian McMillan, Investec Structured Products has seen a distinct increase in the appetite for structured products attributable to four main factors; namely indexation, offshore access, yield pick-up and preservation of capital.

“The South African market has grown substantially since 2008 as investors have realised the benefits of capital preservation products, and the loosening of exchange controls has also seen investors accessing product issued offshore.” he said. “Investec Structured products believes that the efficiency and accessibility granted to the South African financial advisor market via the iTransact platform will see an increase in the awareness and issuance of structured products in South Africa as a result.”

Commenting on behalf of BNP Paribas, Azad Mahavar, Head of UK, Nordic and CEEMEA Sales, Structured Equities & Commodities, said: “BNP Paribas Structured Products provide simple, transparent access to a broad choice of asset classes aiming at capital preservation through a range of innovative structures.

This allows private investors to build a diversified portfolio that is truly orientated to their individual needs and market views. Through iStructure, we now have in place the foundations to support our clients in ensuring they can continuously meet the needs of their customers. BNP Paribas is delighted to be chosen by iTransact as one of the four product providers at this important milestone.”

ABOUT ITRANSACT AND ISTRUCTURE iTransact is a division of Automated Outsourcing Services (AOS) which is one of the largest independent administrators of South African and international units trusts, mutual funds, ETFs, ETNs, hedge funds and listed structured products. Assets under administration exceed R140 billion. The iTransact investment platform was founded to combine all of AOS’ experience and technology to easily and efficiently distribute low cost index products and their benefits to financial advisers and their clients. iStructure adds a third leg to the ITransact product range which already includes the innovative “iSave” (ETFs and ETNs) and “iRetire”(Regulation 28 ETF portfolios). The iStructure range brings state-of-the-art structured products from banks such as Barclays Africa, Investec, Societe General and BNP Paribas within reach of retail investors who now have access to sophisticated investment products previously in the domain of institutional and high net worth individual investors.

Issued on behalf of: iTransact

Client contact: Lance Solms Tel.

No.: + 27 86 143 2383

email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Editorial contact: Kerry Botha

Tel. No.: 083 263 0644

email: This email address is being protected from spambots. You need JavaScript enabled to view it.

South African start-up Riovic, Inc. to provide reliable global money transfer solution

International cash transactions and transfers are complicated and dragging. Sending and receiving money from the United Kingdom to South Africa through MoneyGram or Western Union has a lot of procedures and takes a lot of time. Funds in internet financial services like Paypal and Bitpay and digital currencies like bitcoin are not yet easily usable in the real world in local merchants and stores. Local small business vendors have difficulty accepting credit and debit cards during transactions because of the lack of a simple system that makes that possible and become limited to cash-only transactions which limits the number of sales they make.

Well a start-up based is Pretoria has taken it upon itself to solve all these problems and make the world smaller, or more globalized. Riovic, Inc. provides a cloud-based banking infrastructure and a service that lets people send cheques/checks to each other globally online and convert these cheques/checks into real usable cash within seconds. The money sent comes from their credit/debit cards, paypal and bitpay and the cheque can be cashed online and at authorized Riovic™ finance facilities. They want to enable family members, friends and business partners to send and receive money globally in real-time without any hassle. The only information needed to send a cheque/check is the names and email addresses of the sender and the receiver. Every vendor with an email address will be able to receive payments from credit/debit cards, paypal and bitcoin improving and revolutionizing their business.

The company will provide a service called Riovic TranXact. TranXact facilitates financial transactions and transfers through a cheque/check generating system allowing recipients to receive money in real-time and the service is available globally. Users can save money on the company's cloud-based banking facility in their accounts which is linked to their Riovic bank card. These funds can be used in shops globally, online or can be withrawn at ATMs. The company also has an e-commerce platform which facilitates online sales for virtual goods (e.g. music, ebooks) through a search engine experience. This platform also has a directory for music labels and publishers. The company does not charge any royalties for items sold on the platform but returns all revenue back to labels and publishers.

This new company is determined to break traditions and change the way people transfer money in the world.

TouchFoundry launches “FillApp”, the smart little app that’ll save you money

With the recent volatility of the price of fuel in South Africa, many South Africans find themselves not knowing whether to fill up sooner rather than later, and a misstep could easily cost you over R100. FillApp is a locally developed app, by TouchFoundry, that solves this problem. It’s designed for the person on the go and is easy to setup and use. There is no registration required or pesky ads and its minimalist design tells you only what you need to know.

Once FillApp knows how big your car’s fuel tank is and what fuel you use, it will send a gentle reminder each month informing you of the fuel price change, how much you’ll save and whether you should fill up before or after the change (depending if it’s a price increase or decrease) – that simple. And the best part is: Its 100% FREE

“The aim here was to develop something simple, intuitive and unobtrusive” says co-creator Fabio Longano. “Apps have become an integral part of our lives, but many of them don’t take the consumer into account. FillApp has been designed to fit seamlessly into your day-to-day, empowering locals to save money.”

FillApp uses information available on agency and government websites to predict prices changes. Co-creator Lance Jenkin says that there is a lot of publicly accessible information that isn't necessarily 'accessible' as per say, to the public. “Every-day-people aren't able to access this data efficiently and conveniently when they need to. So we did the time, crunched the code and came out with an elegant product that will hopefully add a touch of convenience to everyone’s lives”

Available for free on both Apple and Android devices here:

Apple: https://itunes.apple.com/app/id954377930

Android: https://play.google.com/store/apps/details?id=com.touchfoundry.fillapp

Founded in 2012 TouchFoundry aims to fill the gap in the market by merging the complexity of code with the artistry of digital to craft exciting, immersive and delightful media. They provide offerings in Mobile Apps, Touchscreen Software, Motion tracking Software, Social media integration and Analytics & Reporting

Website: www.fillapp.co.za

Online Buying and Selling Reinvented

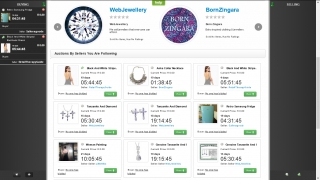

SOUTH AFRICA – Jan, 2015 – After much anticipation LiveBids Auctions has been launched in South Africa. LiveBids offers a unique online buying and selling platform that incorporates different aspects of various social media.

This means that a choice of interests, following friend’s, search hundreds of products while buying items for a fraction of the cost and selling them to make real profits.

LiveBids aims to help buyers and sellers fully connect in trade with seamless transactions. It is an online marketplace that is simple, interactive and social. It allows users to experience a real-time marketplace, buy products lower than the market value and socially follow buyers and sellers.

Two formats are used, namely online auctions and pay-per-bid. The first of these is the traditional online auction model, where items are sold to the highest bidder. The second is a pay-per-bid model, where would-be buyers purchase credits to bid on items. These credits go to the seller, which is how it is possible to purchase big-ticket items for nominal amounts.

The founders of LiveBids, Rory Vollmer and Paul Hoft, explain that “the idea was to create an online marketplace that was simple, interactive and social, helping buyers and sellers connect and trade. The marketplace is completely people driven”.

Visit www.livebids.co.za to empower yourself by becoming an online buyer and seller today!

For further information regarding LiveBids Auctions, or to schedule an interview, please contact:

Contact Rory Vollmer,

Co-Founder and Head of Marketing

Phone: +27 (0) 21 300 8446

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Website: www.livebids.co.za

FINDING OPPORTUNITY IN ADVERSITY – LESSONS FOR BUDDING ENTREPRENEURS

[May 2014, Cape Town] Adversity is something none of us likes to think of, but in a moment one situation can change our entire lives. While insurance companies maximise the reality of this eventuality, most people are still completely blind-sided when adversity hits them. As a result, the obvious by-products of experiencing misfortune can be depression, a complete lack of self-esteem and even financial loss.

Whilst all of the above are very evident across South Africa in the unemployed sector of the population today, there is the occasional diamond in the rough that shines out of a seemingly dark and hopeless situation to just encourage and give back that glimmer of hope that gives budding entrepreneurs an example to glean from.

It is for this reason that the Teen Entrepreneur Foundation of South Africa has created the Awaken the Giant in you breakfast series. The breakfast series aims to showcase the stories of successful South African’s and allow them to share their experiences and life lessons with learners, their parents and organisations wishing to support the development of entrepreneurs.

The next event in the series will take place on Thursday, 22 May 2014 at the Townhouse Hotel, Cape Town at 08h30. Martin Brown CEO of Radical Holdings and professional business speaker will share his journey of overcoming obstacles after being injured in a diving accident. He used creative thinking and his collective experience to change his own life and the lives of others, which kick-started him into a flourishing business.

“Every entrepreneur, young or old will face and have to overcome adversity at some stage of their business journey,” says Lydia Zingoni Founder and Director of the SA Teen Entrepreneur Foundation. “We want to inspire our youth, from a young age that it is possible to overcome and flourish,” she continued.

Teen Entrepreneur Foundation which was started in 2010 exists for the sole aim of instilling a culture of entrepreneurship in teenagers in South Africa.

Come and be inspired by Martin’s entrepreneurial journey and connect with like-minded individuals from government and business entities to fast track your dreams and ambitions.

The event is open to youth, their parents, teachers, community leaders, government departments, particularly those who are tasked with child development and the business community. Tickets cost R150.00 and bookings for the breakfast can be made on-line at www.teenentrepreneur.co.za or at www.webtickets.co.za/event.aspx?itemid=828842321

For more information about the breakfast contact Nadia Snyders on 021 447 6183 or This email address is being protected from spambots. You need JavaScript enabled to view it..

RELEASED BY Stacy De Villiers

Gecko Connect

061 448 6433/ This email address is being protected from spambots. You need JavaScript enabled to view it. ON BEHALF OF SA Teen Entrepreneur Foundation

More about SA Teen Entrepreneur Foundation

SA Teen Entrepreneur Foundation is a registered NPO Trust. The vision of the Foundation is to cultivate and promote the entrepreneurial spirit in all our teenagers through seminars, workshops, conferences and exhibitions. Teen Entrepreneur main target audience is schools, Universities, Churches and Youth Centers.

The organisation is based in Cape Town facilitates engagements across the country

About Martin Brown

Martin was born in Cape Town on February 1971, South Africa. During school Martin was an absolute sport fanatic. His interests after high school led him into the mechanical engineering field and thereafter, into nursing and the emergency medical field. In his second year of medical studies, Martin was injured in a diving accident, leaving him paralysed from the neck down, which forced him to explore other avenues within his abilities.

He is the CEO and Founder of Radical Holdings (PTY) Ltd t/a Radical Mobility, the top designers and manufacturers of power wheelchairs in South Africa. In the past 9 years the company has grown tremendously and supplies international markets.

Martin has won numerous awards such as:

Finalist for the Industrial Category in the 2013 Africa SMME Awards Competition

Sanlam / Business Partners Entrepreneur of the Year® 2012 Finalist

SEDA Most Promising Entrepreneur with a Disability – 2011

SEDA Most Promising Job Creating Entrepreneur – 2011

INSETA National Disabled business leader | 2011

Sanlam and Business Partners Entrepreneur of the Year 2010

SME Award | 2010

Provincial Colours for Athletics | Amateur Athletics Association of South Africa | 1990

National Colours in Acrobatics | Acrobatic Federation of South Africa | 1992 – 1997