Inflating home values to secure a sole mandate

Written by: The Press Team Save to Instapaper

The topic of whether agents inflate home values to secure a sole mandate has once again come under scrutiny. This is particularly relevant in light of the market shifts that have occurred over the past three years, including the pandemic-induced interest rate changes. While inflating property values is not a common practice among professional property practitioners, it does occur from time to time.

It is important to gain insight into the reasons behind the inflation of property values. Sellers often have high expectations for their homes, believing that they are worth more than they actually are. This is understandable, given the time and money invested in maintenance and improvements. However, it can lead to disappointment when sellers are made aware that similar properties sold three years ago for significantly less.

This is a reality that I have personally experienced. When I sold my property a year ago, my neighbor, whose home was practically identical, expected a valuation in line with my sale price. However, he had to manage his expectations down by R200,000. Similarly, my parents recently sold their property for R100,000 less than they paid for it five years ago.

It is the responsibility of agents to manage sellers' expectations by keeping them informed about where buyers see value. However, it is crucial that sellers trust their agents and believe that they are taking their needs seriously. Agents must be willing to test the market to see if the sellers' price aspirations can be met.

It is worth considering whether it is the seller, rather than the agent, who is driving the inflation of property values. Even when presented with credible comparative market analysis and feedback from prospective qualified purchasers, some sellers insist on marketing their property at an over-inflated price. The reality becomes evident when the property sits on the market for more than three months.

In conclusion, while the inflation of property values is not a common practice among professional property practitioners, it is important for agents to manage sellers' expectations and provide them with accurate information about the market. Ultimately, it is up to the seller.

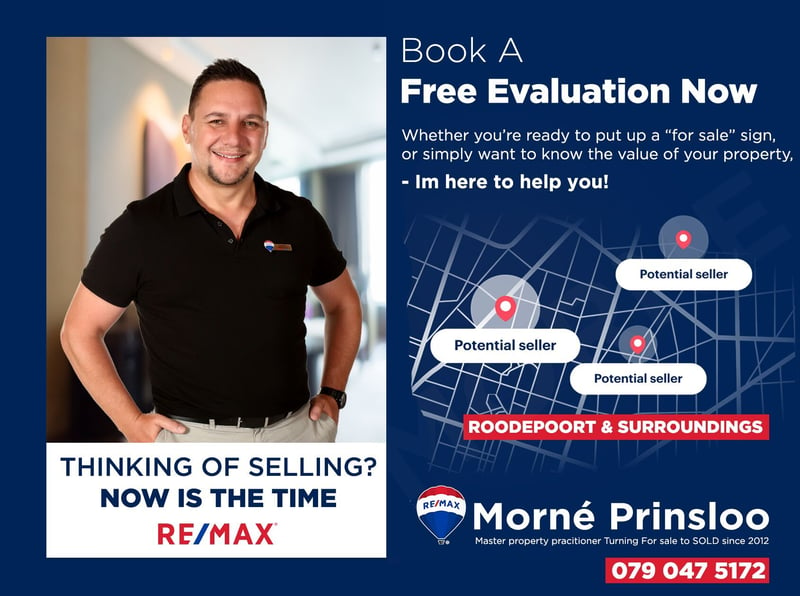

For precise and reliable information on the sale of your home, look no further than Morne Prinsloo at RE/MAX Masters. As one of the leading property practitioners in the Wilgeheuwel, Strubensvalley, Little Falls, and surrounding areas, Morne has established himself as an expert in property valuations. With a commitment to excellence and a wealth of experience, Morne is dedicated to providing his clients with the highest level of service and support. Give Morne a call today at 079 047 5172 or go to his website and take the first step towards a successful sale.

Get new press articles by email

Morne Prinsloo | RE/MAX Buying Or Selling Agent

Morné Prinsloo - Real Estate Agent Roodepoort and Krugersdorp44 Press Release Articles

I’m Morne Prinsloo from RE/MAX Town and Country, assisting homeowners and buyers across Roodepoort and Krugersdorp since 2012. You get free, accurate home valuations, straightforward advice, and strong local insight for pricing, marketing, negotiation, and smooth transfer. Service areas include Roodekrans, Wilro Park, Helderkruin, Little Falls, Strubens Valley, Honeydew Ridge, Wilgeheuwel,... Read More

Latest from

- Sell your Roodepoort or Krugersdorp home with a results-driven local agent

- Your Comprehensive Guide to Roodepoort Real Estate - Neighbourhoods, Market Trends, and Expert Advice

- Properties Wanted | Expert Real Estate Services in Roodepoort

- Discover Your Dream Home with Morne Prinsloo

- My journey with RE/MAX Masters - Morne Prinsloo Roodepoort Real Estate Expert

- Top 10 Reasons Sellers Should Choose Me as Their Real Estate Agent

- Introduction to Wilgeheuwel and its Real Estate Market

- Featherbrooke Estate - Your Premier Choice for Quality Living | RE/MAX

- Discovering Excellence - RE/MAX Masters Ruimsig (Featherbrooke)

- How the right agent can maximise your homes value!

- Morne Prinsloo - Your Trusted Partner in Real Estate | RE/MAX Roodepoort

- Difference Between Buyer's and Seller’s Market | Roodepoort Advice

- Why Choosing the Right Real Estate Agent in Roodepoort Matters!

- Living in Roodepoort | Roodepoort at a glance

- The Dangers of Overpricing a Home in a Downturn Real Estate Market

The Pulse Latest Articles

- Education Is The Frontline Of Inequality, Business Must Show Up (December 11, 2025)

- When The Purple Profile Pictures Fade, The Real Work Begins (December 11, 2025)

- Dear Santa, Please Skip The Socks This Year (December 10, 2025)

- Brandtech+ Has 100 Global Creative Roles For South African Talent (December 9, 2025)

- The Woman Behind Bertie: Michelle’s Journey To Cape Town’s Beloved Mobile Café (December 9, 2025)