The bank says that those who register for financial education on Fincents will be able to download content to allow for learning offline.

"According to the FSCA Financial Literacy Baseline Survey, 48% of South African adults struggle with basic financial literacy. And, with women and underserved communities bearing the brunt of this knowledge gap, we view it as critical for us to open up our capabilities and expertise to empower South Africans from all walks of life with potentially life-changing financial knowledge," says FNB Personal Segment CEO, Lytania Johnson.

FNB's data shows that consumers tend to have specific and apparent financial education needs, such as access to content that relies less complicated financial language and terminology. Our data shows that South Africans have general fear and anxiety when it comes to the topic of personal finances. Moreover, consumer education data also shows that financial information is not always easily retained by individuals after a single interaction. As a result, to enhance knowledge retention, education efforts need to be centred on addressing these challenges in an appropriate and easily digestible manner," adds Johnson.

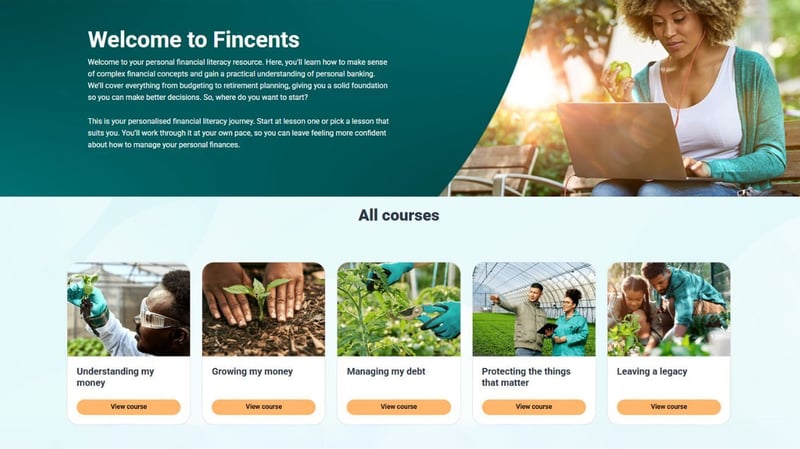

"With this in mind, we have tailored the content and information available on the Fincents website to meet these requirements by offering users core financial education support. Our team tapped into its experience working in communities across the country and partnered with digital content experts to craft an interactive learning platform that allows users to learn through storytelling, quizzes and contextual content," says Dhashni Naidoo, Programme Manager at FNB Consumer Education.

Fincents takes users through five content pillars and 13 combined themes, ranging from topics such as budgeting, saving, identifying financial scams, to managing debt and retirement planning, says the bank.

"Ultimately, our aim in this knowledge transfer exercise is not only to improve financial literacy levels but also to positively and sustainably influence attitudes and perceptions about the importance of personal finances," says Johnson.

"What's exciting about Fincents is the fact that it will allow us to empower as many South Africans as possible with accessible and interactive multimedia learning tools — something that we haven't yet done as a bank, until now," adds Naidoo.

With the bank set on establishing Fincents as a trusted and well-used source of financial education among a broad cross-section of the population, it also intends to provide content in various South African languages and sustainably improve financial literacy levels among users. In fact, FNB says this first phase of the website is just one of the steps FNB is taking to ensure it further develops its existing consumer education efforts.

Over time, the bank says it plans to enhance the website's features and expand content areas to meet the growing financial literacy needs of consumers. "We're actively exploring including content around additional subject areas like homeownership, vehicle finance, cryptocurrency and more. We also plan to include specialised content tailored to niche audiences, such as educators (for use in the classroom) and parents (for age-appropriate financial conversations with their children)," Naidoo says.

Financial literacy is not only critical on an individual level, "it's also critical for families, communities and the broader economy. And, by opening the platform up to all South Africans, FNB hopes to be able to play a critical role in improving the quality of financial inclusion, increasing financial wellness and financial stability among vulnerable members of our communities and empowering them to secure their financial futures," concludes Johnson.

For more information, visit www.fnb.co.za. You can also follow FNB on Instagram.

*Image courtesy of contributor

Latest Press Articles

- Astron Energy Partners With 2025 Comrades Marathon

- Meet The People Acquires Yeoman Technology Group

- Effie Awards South Africa Announces 2025 Jury Panel

- Broadsign Unveils Automated In-advance Dooh Transactions

- Honouring The Youth- A Celebration OF Courage, Commitment, And Change

- Who Owns Digital? New Model Emerges As Marketing, Finance And Operations Must Share Stewardship

- Sportsbet.IO Appoints Five New Ambassadors

- Get Ready TO ACE Your Marketing Game!

- Caster Semenya, Gerda Steyn Partner With OMO TO Champion Resilience At Comrades Marathon

- SA Safari Lodges Lead Solar Shift TO Future-proof Tourism

- Transform Your Business Culture Through Customer Experience

- Why A Sick Note Won'T Get You Out OF A Disciplinary Hearing

- SA Rolls Out First Mass Poultry Vaccination TO Curb Avian FLU

- African Energy Week (AEW) 2025 African Energy General Counsel Forum TO Spotlight Strategic Legal Leadership, Dealmaking And Doing Business In African Oil & GAS

- Natural GAS And Africa’s Energy Future- Balancing Growth And Sustainability (by Adrian Strydom)

The Pulse Updates

- Xlink Crowned Technology Company Of The Year At The Africa Tech Week Awards 2025 (June 5, 2025)

- Celebrate International Day Of Play With The Weirdest (and Most Wonderful) Toys Of 2025 (June 4, 2025)

- Switching On The Future - Landmark Electricity Expo Comes To Joburg (June 3, 2025)

- Timeless, Bold, And Distilled With Care - Just Like Dad (June 2, 2025)

- New Report Reveals Msme Funding Realities In South Africa – And What Must Change (May 30, 2025)