South Africa participates in largest crowdsourced Global Giving survey to empower NPOs

With over 150 000 charity organizations in South Africa, it is clear to see why we are known as a warm-hearted nation. With so many non-profits doing their part to elevate their various causes, it is the perfect time to dig deeper and investigate our unique stance on philanthropy.

A new survey, put together by Non-profit Tech For Good is hoping to provide insight into our budding non-profit sector through the 2018 Global Trends in Giving Survey. A report which will be the first of its kind.

The survey, available in five languages; Arabic, English, French, Portuguese and Spanish, aims to crowdsource the largest global survey of individual donors ever, partnering with 21 Non-profit organizations to better understand generosity in the charity space.

Representing South Africa in the study, which is already in circulation, is donations based crowdfunding platform, BackaBuddy, a strong contender in social giving. The organization has raised an astounding R65 Million for charities and individuals alike.

“The goal of the 2018 Global Trends in Giving Survey is to gain a better understanding of how donors worldwide engage with causes and charities that resonate with them. Partnering with BackaBuddy we hope to gage an understanding of the ‘spirit of Ubuntu’ in the emerging market that is South Africa” – says Non-profit Technology Trainer, Heather MacDonald

We would like to encourage South Africans to join the conversation and lend their voice to the report. The results will allow our charities an opportunity to learn from each other and align themselves with latest the market trends to better serve our community.

The survey is 100% anonymous and only takes 5 minutes to complete. Click here: https://givingreport.ngo

Energy and water sectors excited by solar PV, technology innovation and distributed generation but view corruption as biggest challenge

African Utility Week industry survey yields interesting results

Solar PV is overwhelmingly seen as the most promising generation source for Africa while corruption, skills gaps and access to finance are some of the biggest challenges that power and water professionals face in their industries. This is according to a survey by the organisers of African Utility Week among attendees of the annual event in Cape Town last year. Other questions in the survey included what respondents think will have the biggest impact on the energy and water sectors, what future technology excites them and what the biggest challenges are that they face in their industry.

Of the 834 people surveyed, 696 are South African (71%), 199 are from 24 other African countries (63 Kenyan, 85 Nigerian) and 40 from the rest of the world, including Europe, USA, China, India and Canada.

Most promising generation source

Asked what the most promising source of generation is for Africa, Solar PV scored more than 54% amongst the respondents while nuclear was second with 11%. “The reason could be that rooftop PV, when measured against the other technologies, is easy to execute as a project and photovoltaic modules are becoming very affordable,” says Nicolette Pombo-van Zyl, editor of the energy trade journal, ESI Africa.

She adds: “it is also the most obvious technology to use in mini- and off-grid projects as well as for use in hybrid models. However, what is interesting but not surprising is that 11% of respondents feel that nuclear energy is the most promising generation source. Nuclear has its merits. What is disappointing is how few are in favour of biomass as a promising source of generation capacity, considering that this technology offers a distributed model and a measure of reducing the mounds of waste that Africa’s cities are confronted with. Another concern is the lack of interest in wind energy – only 8% of respondents felt this technology a worthy source; however, it does rank slightly higher than hydro where the continent’s impressive potential capacity is recorded. Wind energy is likely to make tentative steps towards market growth now that South African, Kenyan and Moroccan wind farms are making good headwinds.”

Nuclear scored the lowest amongst power and water professionals when asked what they think will have the biggest positive impact on the energy and water sectors in Africa within the next 5-10 years: (Respondents were allowed to select more than one of the 12 options provided.)

- Technology innovation 59%

- Government commitment and transparency 55%

- Uptake of renewables 47%

- Expansion of mini grids 28%

- Distributed generation 25%

- Cross border partnerships 24%

- Investment in capacity building 21%

- Local investment 21%

- Direct foreign investment 20%

- Roll out of ICT systems 9%

- Nuclear 7%

“Even though nuclear made a spectacular appearance in the previous question, here it ranks lowest, with technology innovation taking the prime spot” says ESI Africa’s editor, adding that “Tech R&D in all spheres of energy, power and water are already advancing with enthusiasm. And sometimes the simplest of solutions can be developed for the specific needs of a local community making the most impact. This is made possible by various organisations that are investing in entrepreneurship programmes and providing support to local innovators.”

She continues: “the other key area that respondents are hopeful will make a positive impact is around government’s commitment and transparency. Now that there has been an increase in public and industry association monitoring groups, such as OUTA and SAWEA, along with the ongoing Eskom Inquiry and South Africa’s leadership changes – this area is set on the right path to make a noteworthy impact.”

Future technology

Asked which future technologies most excite the respondents, the results were as follows:

- Smart Grids 54%

- Energy storage 49%

- Energy trading 49%

- Connected/smart cities 37%

- Electric vehicles 36%

- Energy trading 14%

- Blockchain 14%

“These results show an interesting grouping around smart grids, energy storage and energy efficiency, which are intrinsically connected,” says Nicolette Pombo-van Zyl. “It’s disappointing that energy trading and blockchain are perceived as too futuristic to be the technology that respondents are most excited about. The African continent was able to leapfrog landline telephony straight to mobile; countries can do this again by becoming the leaders in energy trading and the use of crypto currency to fund projects and transact in the utility, energy and water space.”

That the market has a healthy appetite for the futuristic technology was confirmed in a separate question whether the market is ready for the digital utility with a focus on smart meters, grids, Internet of Things and ICT – the overwhelming reply was a yes from 84% of the respondents.

Biggest challenge = corruption

At 49%, corruption was indicated as the biggest challenge that power and water professionals face in their industries but issues such as skills gap, access to finance, regulation and policy clarity, red tape and economic slowdown were also perceived as important hindrances, scoring from 36% to 28%.

Says the ESI Africa editor: “corruption is still perceived as a major obstacle and this goes along with respondents’ strong call for government commitment and transparency. It will take concerted leadership from all levels of government to rid the continent of this deeply entrenched challenge. The skills gap is also pinned as a high concern, putting development at risk – the loss of engineers, technicians and managers who are now retired or close to retirement age is a real factor; perhaps reviving apprenticeships along with attractive offers would make inroads to solving this risk.”

The future lies in…

When asked the question: “The future lies in:” and given four choices only, namely distributed generation, mini grids, utility scale grids and storage, distributed generation was a clear winner at 40% with storage second at 27%, then mini grids with 22% and utility scale grids scoring the lowest with 11%.

According to Pombo-van Zyl, distributed energy resources (DER) are top of mind as an imminent risk to the traditional utility and municipality business model – and not just in Africa. She explains: “it is being discussed at all levels of the utility business from its executive boards to internal auditors as it poses a threat to traditional revenue streams. However, the good news is that utilities have acknowledged a future that includes distributed generation – the challenge is in how to manage the technicalities around accommodating this on the national grid and its impact on revenue.”

She adds: “it must have been a tough choice for survey respondents to choose between distributed energy, mini grids, utility-scale grids and storage. This is evident in the close percentages, with the obvious outlier being utility-scale grids; probably due to grid connected generation having made little inroads on increasing electrification rates across the continent.”

Skills deficit in power and water sectors

Skills in finance, engineering/technical, people management and leadership all scored high (29%-33%) in a question on what power and water professionals perceived to present the biggest skills deficit in their companies. The ESI Africa editor’s take on these results: “it is a concern that there is a joint winner from this question: finance and engineering/technical skills. Without these two significantly important skills being resident within the utility market it is no wonder that companies’ cash flow is untenable and technical losses along the value chain are present due to maintenance challenges. A potential solution lies in leadership and people management, which also scored very high in this question.”

Award-winning energy platform

The 18th annual, multi-award winning African Utility Week will gather over 7000 decision makers from more than 80 countries to discuss the challenges, solutions and successes in the power, energy and water sectors on the continent. Along with multiple side events and numerous networking functions the event also boasts a seven track conference with over 300 expert speakers.

The African Utility Week expo offers an extensive technical workshop programme that is CPD accredited, free to attend, and offers hands-on presentations that take place in defined spaces on the exhibition floor. They discuss practical, day-to-day technical topics, best practices and product solutions that businesses, large power users and utilities can implement in their daily operations.

Industry support

African Utility Week has already secured important industry support including Eskom Rotek Industries, Hexing and Landis+Gyr as platinum sponsors and Aberdare, Africa Utility Solutions, SAP and Sensus as gold sponsors.

Dates for African Utility Week:

Conference and expo: 15-17 May 2018

Awards gala dinner: 16 May 2018

Site visits: 18 May 2018

Location: CTICC, Cape Town, South Africa

Website: http://www.african-utility-week.com & www.african-real-estate-summit.com

Twitter: https://twitter.com/AfricaUtilities #AUW2018

Linkedin: African Utility Week

Contact:

Senior communications manager: Annemarie Roodbol

Telephone: +27 21 700 3558

Mobile: +27 82 562 7844

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

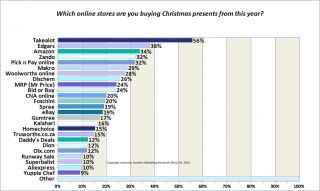

Takealot and Edgars are SA’s top online retailers for Christmas 2016

According to a new survey completed in the first week of December, Takealot and Edgars are likely to be the most popular online retailers for Christmas 2016. The survey also revealed that almost a quarter of South Africans have reservations about shopping this Christmas. The survey was conducted by Acentric Marketing Research (Pty) LTD, using both online and telephonic survey modes (see technical note). Nationally, 24% of South Africans are not likely to shop specifically for Christmas this year. As of early December, 36% still intended to complete their Christmas shopping, while 40% had already finished. Of those South Africans with internet access, almost 63% planned on shopping both online and at physical stores, while 35% intended on only shopping in physical stores. “Around 55% of those with internet access expected to have to increase their spend this year on Christmas shopping, with 27% spending the same and only 15% expecting to be to spend less. An average spend of R4,300 is expected this year amongst internet enabled South Africans.” says Craig Kolb, MD of Acentric.

Where are you planning on shopping this holiday season?

Takealot took the lead as SA’s most popular online retailer. “Takealot has grown immensely since this was last measured in 2012. I believe the takeover of Kalahari benefitted the brand tremendously. Many consumers still seem unaware of the takeover, however, as 16% of consumers still intend purchasing from the Kalahari brand.” says Kolb. Takealot was followed by Edgars, Amazon, Zando, Pick n Pay, Makro and Woolworths. “Another notable result is the rise of the brick and mortar retailers. In 2012, traditional retailers hardly made a dent, bar a few supermarket retailers. Now everything has changed. Most notably Edgars, Pick n Pay, Makro, Woolworths, Dischem and Mr Price have now made large inroads into this space. I will know more once a more detailed post-Christmas survey - for the Online Retail Brand Report - is completed next year.” says Kolb.

Which online stores are you buying Christmas presents from this year

Technical note: An online-panel survey using an ISO 20252 panel was conducted during the late November, early December period. Post-weighting was applied to provide approximate representation of the SA online population in terms of age, gender, ethnic group and household income. Depending on the questions, between 347 to 223 participants responded, yielding margins of error between 5.3% and 6.6% respectively, at a 95% confidence level (unadjusted for design effect). Average spend figures were rounded to the nearest R100.

For further information, please contact:

Craig Kolb

Acentric Marketing Research (Pty) LTD

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.