Lavazza Coffee to be re-launched in SA’s retail space by Incobrands.

From a small grocery store opened by Luigi Lavazza in 1895, Lavazza coffee was born. It is synonymous of excellent Italian Espresso in over 90 countries and the leading brand of coffee in Italy. Lavazza coffee has been on an endless journey of innovation from blending coffees from different parts of the world to catering to the tastes of individuals, to new roasting machines that ensure aromatic excellence and allowing coffee to be prepared with beans and a capsule. Lavazza is a global leader and a premium coffee specialist true to exploring, discovering and reinventing the art of blending.

Lavazza coffee is being re-launched in October 2018 by Incobrands into leading South African retailers like Pick n Pay, Checkers and Spar.

Retail Product Range

Qualità Oro is the very first Lavazza blend, created in 1956 and is available in retail stores. The coffee is ideal for those who love to savour a premium blend daily. Made from a selection of the finest 100% Arabica beans, mainly from Latin America, this blend is fruity and aromatic, with hints of malt and honey suitable for all coffee makers.

Qualità Rossa is rich and full-bodied coffee, perfect for those who want to get off to a great and energetic start to their day. This uniquely blended coffee is made from a combination of Brazilian Arabica beans for body and sweetness with African and South East Asian Robusta beans fir intensity and warm notes of cocoa. It is a richly flavoured coffee ideal for an everyday coffee with its intense and energetic blend.

Crema E Gusto is ideal coffee for any occasion, with the perfect combination of intensity and full-body for the perfect latte and caffe latte. This creamy and full-bodied blend consists of a selection of high quality Arabica and Robusta beans with a fragrantly flavour and pleasant chocolatey finish. A classic Italian coffee and amongst Italy’s best sellers!

For the decaffeinated coffee lovers, Caffè Decaffeinato is the ideal decaf offer by Lavazza. Lavazza decaffeination method is natural and preserves the authentic taste of the quality coffee beans. The natural method results in a coffee rich and full in flavour and body, with notes of honey and almond. This coffee is perfect for any time of the day or night.

Lavazza Prontissimo offers more than just an instant coffee, it is a 100% Arabica blend enriched with 10% finely ground coffee to get a great premium tasting instant coffee. Prontissimo! CLASSICO presents a round and well-balanced taste with top notes of caramel. Prontissimo! INTENSO presents a strong and full-bodied taste with notes of roasted beans. For the taste lovers, Lavazza Prontissimo makes an extraordinary taste experience, in an instant!

Compatible Capsules

Through dedication to innovation and quality, Lavazza has launched a new line of capsules compatible with Nespresso®* domestic machines. The creation of the capsules begins with a “Noble Dark Roasting” method — developed by the company – with the aim of extracting the most “noblest” of aromas. This is coupled with a velvety grind that yields a superior in-cup result, guaranteeing a smooth and even coffee extraction which preserves all the richness of flavours. The grinds are then blended with others from coffees of diverse origins to create a unique flavour profile for each product. Subsequently, to maintain all the freshness and aroma of the coffee, the blend is packed and sealed in a protective atmosphere with a technology called “Aroma Safe”

The new capsule line is a result of Lavazza’s expertise in leading the coffee industry with quality and innovation, combined with almost thirty years’ experience in the production and marketing of systems and products for the single serve segment.

END

*Capsules compatible with Nespresso® domestic machines. Nespresso® is a trademark of a third party without any link with Luigi Lavazza S.p.A.

The talk of the town

“The retail tenants of the much-anticipated Park Square development on the Umhlanga Ridge are going to change the way the locals see convenience.” This is a big statement from Park Square’s Ken Reynolds, Nedbank Property Finance Divisional Executive, property expert and Director of Nedport Developments, a subsidiary of Nedbank and Park Square developers. As one of the key members behind this important development, Reynolds reinforces Park Square’s focus on keenly bringing together work, leisure and convenience and given his track-record, he knows what he’s talking about. With an offering as attractive and unique – aesthetically and financially - as Park Square, Nedport has absolutely nailed their concept with the acknowledgement that the right retail and commercial mix is vital to the success of any urban hub.

Dedicated to servicing the needs of their commercial residents in addition to the burgeoning surrounding residential suburbs, this prestigious and on-point development is paving the way for Spar to be an anchor tenant in the nearly complete building – and this important tenant will be a game-changer for the greater Precinct. Mark Anderson, who has earned a solid reputation of delivering world-class retail environments (if his magnificent uMhlanga Rocks Superspar - is anything to go by) says, “Park Square is both an ideal environment for us to grow our vision to bring to market the very best concept retail offerings in KwaZulu-Natal, if not the country.” The financial viability of the developments’ location and concept is one that has made the investment particularly appealing and exciting, Anderson also confirmed.Park Square Spar Park Square is set to fulfil the core vision of the development, which will offer seamless integration for a work-play lifestyle. With its considered mix of restaurants, shops and coffee bars, Park Square will offer a connected work culture incorporating a unique leisure offering seamlessly linked to a vibrant and open urban square. The term ‘top-tier’ is not often used to describe a grocery store, but like Ken Reynolds, uMhlanga Rocks Superspar Owner, Anderson believes his new Spar, the retail anchor tenant of Park Square, will reshape how locals view their daily shopping experience.

The Park Square Spar franchise will occupy up to 1 500 square metres of space, of which 150 square metres being a TOPS.Using the reference of the uMhlanga Rocks Superspar, consumers are set to be enchanted and delighted by the offerings Spar Park Square has in store. Walking through the uMhlanga store, one is impressed with the attention to detail that has gone into the planning and daily operations of the store. At every corner you are bound to see someone sweeping, mopping or tidying up. It’s no wonder that Mark can confidently say, “I have the cleanest store in the world.” What is clearly evident when you meet the owners of the soon to be Spar Park Square, is his passion and dedication to creating a destination for the consumer that is not only entertaining but well considered. “Our driving force is to exceed our consumers expectations. People no longer want to merely shop, they want an experience. This is what we are offering to them here – and more.” Great service, convenience and a variety of offerings are the foundation of what will likely be the most talked about store in South Africa. Consumers will have plenty to choose from, from general merchandise, gifting, imported goods and home replacement meals. The home replacement meal section will offer quick, healthy and freshly made food options suitable for an array of dietary needs including but not limited to gluten-free, banting and vegan dietary needs.With convenience in mind With convenience in mind, Anderson is working on an App that will allow tenants of Park Square to order their food, pay online and pick up at the end of the day. Once the App proves successful, it will be open for uMhlanga Rocks Superspar consumers too. However, they are not solely focused on health products, but will also have a delicatessen, a pizza, burger and pita bars. Word on the street is that there will be an exclusive whiskey tasting area for the connoisseur – but this is one secret that is still under wraps for now. “We are giving the consumer the ability to choose. Spar Park Square will be a shop within a shop,” Mark adds. Designed around an aviation theme, Spar Park Square will boast interesting features such as a rickshaw from India and a reception desk made from an aeroplane cockpit, making it arguably one of the first retail grocery stores in the world to have an official reception area.Following in the footsteps of Park Square’s 4 Star Green Star rated development, Spar Park Square, will have fridges with doors allowing for an estimated saving of up 30% on electricity but most importantly, the temperature of the fridges will be kept more constant which helps to prevent bacteria.

“But retail is not just about being functional,” he adds. “The global trend is to have mixed-used development with residential and retail centred around an engaging and multi-dimensional square and this is just what Park Square offers, as the perfect complement to the thriving business hive of the uMhlanga Ridge Town Centre, making it a fully operational hub, servicing all needs,” says Anderson. “We want people “We want people to come here because there is something to see. The visibly appealing Park Square will bring beauty and vibrancy to the area too.”Mark adds, “Customers no longer want to do a grocery shop in large centres due to the long walks. They want the convenience of parking, walking straight in, shopping, and walking out.” The covered on grade retail parking bays allow for this convenience x-factor and the location and access planning of Park Square make for easy accessibility for all customers, with Park Square’s close proximity to the IRPTN bus route as well as the Chris Saunders Park. “Based on the concept and location,” a confident Anderson concludes, “we’ll have everything for tenants and the greater upper uMhlanga neighbourhood, and our opening on the 1st of November this year, can’t come soon enough.”

To explore investment opportunities email This email address is being protected from spambots. You need JavaScript enabled to view it. or visit: www.parksquare.co.za to find out more.

Water Watch in Cape Town

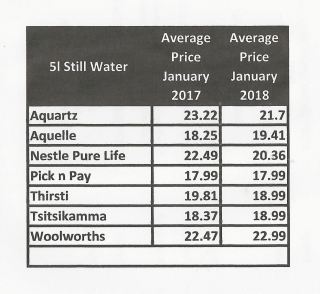

The prolonged drought in the Western Cape and the threat of “Day Zero” has given rise to fears of price hikes in bottled water yet Retail Price Watch, the consumer price watchdog, has found that major retail chains in the region are sticking to 2017 prices for 5l bottled water.

The net effect is that there has been a rush on bottled water and many stores have found themselves temporarily out of stock, says Viccy Baker of Retail Price Watch.

“Under normal circumstances demand pressure would have increased the price of the larger sizes, but instead stores have been offering specials which have cleared their shelves, even if only for a short time,” she says.

“Retailers are to be commended for not capitalising on the shortage although it is very likely that consumers who are already very angry about the way the water crisis in the Western Cape has been handled, would not tolerate large price hikes,” she says.

“On 25 January Woolworths in the Southern suburbs of Cape Town which sells its house brand for R22/5litres, was offering 2 bottles for R31 and the shelves in most stores were cleared before lunchtime.

“Pick n Pay and Checkers Blue Route were out of stock but promising deliveries on 26 January while Checkers Muizenberg is selling its house brand Eastern Highlands for R15 a bottle.”

Judy Woodgate of Tstsikamma Crystal Water in the Eastern Cape says that demand has been “unprecedented” with her sales managers witnessing people fighting over the last bottle of water on shelves in supermarkets in Cape Town.

“We have been besieged not just by retailers but by members of the public who want to buy at source because they cannot buy from the stores,” she said.

“We are bottling as fast as we can and have an order book which will fill 31 trucks all headed for Cape Town in the next week.”

Woodgate offers a caution to homeowners wanting to buy large quantities of water – many opting for truckloads of more than 5000 litres - that storage in the sunshine can offer water deterioration over time.

Baker says that empty 25l plastic bottles have been sold out at stores such as Mambo’s and Plastic World.Monique Hector, a spokesman for Mambo’s confirmed that the Cape stores had experienced increased demand and had sold out. “We are expecting deliveries but cannot say when.”

Baker says that over the past year prices of 5l bottled water around the country have generally stabilised (see Table below).

A Muizenberg resident Heather Hirschman (57) who lives on the 10th Floor of her apartment block said the 87 litres per day that Capetonians had been allowed over the past few months was far too much given the current crisis and that the authorities should have acted earlier to restrict the use of water further and to hike the price for higher levels of water usage. “It is inconceivable that older or disabled people will be able to manage to carry 50 litres of water per day from taps to their homes,” she said.

Checkers vs Pick n Pay vs Shoprite vs Spar in 2017

In 2016 independent consumer website Retail Price Watch conducted a survey of prices across South Africa’s seven biggest chains in four different categories. The items surveyed were national brands which were selected solely on the basis that they are available from all stores.

This year the comparison was slightly truncated because the same brands were not available at all stores: nevertheless the four “big name stores” are still represented.The chains were Checkers, Pick n Pay, Shoprite and Spar. The categories were baking ingredients, beverages, cereals and porridge, and staples.

The average price of each item in May from stores around the country was used in order to ensure that a single “special” did not unduly weight the overall price of the item.

Pick n Pay proved cheaper than the other three stores in all categories, although by a narrow margin in the Cereals and Porridge category, with less than one cent separating it from its nearest rival Checkers.

“It is noteworthy that only cereal and porridge prices appear to have stabilised or slightly reduced since July last year, while others continue to rise,” says Viccy Baker of Retail Price Watch.

Spar as the most expensive was 5.5% higher than Pick n Pay in the Baking Ingredients category and 5.1% more expensive in the Beverages category. Shoprite was the most expensive in the Cereals and Porridge category, with Pick n Pay beating it by 7.7%. In Staples, Spar came out an average 8.7% more expensive than Pick n Pay.

“This survey is not a basket of goods but it does present a rare opportunity to compare apples with apples, something stores and suppliers are very keen to prevent consumers from doing.

“For example, Cremora dropped its 1 kg pack (surveyed last year) for an 800g pack. The price appears to be lower yet if you adjust the price back to the kilogram price, you will find out that you are paying more per gram for the 800 gram pack than you were for the kilogram pack – “shrinkflation” in action!

“An objective price comparison also provides a reality check in demonstrating that prices move in a very narrow band and are similar over time, no matter which store you buy from. It’s up to consumers to demand value for money and not be taken in by so-called special offers (you have probably been paying more than the average for the special over the past few months so that it will appear as if the price has dropped). “

Toblerone, the US Elections and the South African Consumer

“All the dazzling technology, the big data and the sophisticated modeling ….could not save American journalism from yet again being behind the story…”

“Data is Dead”

Media commentators on the failure of the news media to predict a Donald Trump victory in the latest US Presidential elections.

“This idiocy from a company based in a country that offers its electorate the choice of president between a liar and a bully.... Well done Mondelez you just don't get it do you... you've taken yet another confectionary (sic) icon and have trashed it.”

A Facebook post after the manufacturers of Toblerone decided to reduce the size of its iconic triangular product and increase the gaps between the chocolate triangles.

Are South African FMCG retailers and manufacturers also guilty of “just not getting it” to the detriment of their relationships with customers?

Viccy Baker of Retail Price Watch, the consumer website which gives customers more choice when it comes to their purchase of household goods, believes that there is a profound disconnect between what customers expect from their brands and retailers, and what is being delivered.

“There is a plethora of research houses and an alphabet soup of acronyms and buzzwords serving the retail industry in this country.

“Amidst all this noise the consumer’s trust in brands is rapidly disintegrating – and nobody seems to notice. Just three factual articles published by us in the online press about FMCG issues this year attracted 150 negative comments and fewer than five positive comments about retailers, from consumers.

“I think that there is outright profiteering going on with regard to food. Not to mention price fixing.”

“Let’s burn all the supermarkets.”

“So beware specials, very often the only special about them is that they are not special.”

“Bunch of scammers.”

There is general agreement that online comment on news stories represents the lowest level of communication. Nevertheless the simmering resentment that people feel against certain issues first rises to the surface here and on social media, and hard lessons have been learnt about ignoring it.

Baker cites recent examples of manufacturers and retailers riding roughshod over consumers.

“Bruce Whitfield spent more than five minutes berating Toblerone on the 702 Cape Talk Money Show last week, yet this is only one of more than 50 examples of “shrinkflation” recorded by our website over the past two years. Toblerone is an exception in that it at least took the trouble to inform its customers of the impending changes. In most instances neither manufacturers nor retailers bother. The barcode remains the same despite the change in the product, directly against good retail practice.

“Pick n Pay Tuna for Cats jumped in one month from R9.99 to R17.99, an 80% increase with no apology or explanation.

“Ritebrand Rooibos Tea 80 units sold by Shoprite, has increased in price by 54% since November last year, from an average of R18.19, to an average R27.99. This is shocking enough, considering that Rooibos tea is a 100% South African product. Yet 80 units of Lipton tea are now selling for an average R53.56, 106% more than November last year. No justification from the manufacturer or the stores, although Unilever declares it is “redefining” sustainable business practices and trying to keep jobs alive.

“Some Spar stores are now selling Snowflake flour 2.5kg for R32 a bag, and on average Spar’s cost of Snowflake is more than 23% higher than it was this time last year. Spar recently introduced a house brand canned mushrooms 285g tin. In fact the proportion of mushrooms in the can is 40% - meaning that the consumer is paying for 60% salt water!

“Woolworths, infamous in many people’s minds for its high prices, shows far greater consistency in its pricing. Presumably consumers are prepared to put up with high prices in return for a level of trust in this retailer.

“In a basket of 20 national brands measured over a 3-month period this year, Woolworths changed the price of five products. Checkers changed the price of all 20 products, multiple times, as did Pick n Pay and Shoprite, with Spar close behind. Although some of the price movements were down, this often followed a steep hike (in one instance of 48%).

“Bewildered consumers now feel they enter these stores on the defensive, and the sight of merchandisers with long rolls of PI labels moving down the aisles fills them with a sense of panic.

“In contrast, when the price of sugar rose by 15%, Makro (not always blameless in its treatment of consumers) took the trouble to inform its customers well in advance so they could stock up before the price hike hit. This made good business sense for Makro and also put it into a favourable light with its customers.

Baker believes that loyalty programmes and specials have become ways for the consumer to feel he/she is “getting back” at the retailers, and are not in fact gaining greater brand loyalty.

“The researchers got it wrong when they dismissed Trump supporters as being un-American. Toblerone got it wrong by trying to cover a bitter pill with a sweet coating. There is a wave of civic action spreading throughout South Africa. Will it eventually reach the consumer sector?