Huawei’s P30 range: It’s all about the zoom

There is no doubt that the P20 series launched last year from Huawei was a global success. Following on the Huawei Mate20 Pro was voted product of the year 2019. This phone takes ridiculous photos for a reasonable price. The Huawei P30 co-engineered with Leica is rewriting the rules of photography. Brighter, wider and closer. See the world from new perspectives. Discover the unseen surprises and turn them into your treasured memories. The HUAWEI P30 is pushing the envelope of smartphone photography.

That said The Huawei P30 offers you a best-in-class camera setup and a terrific design while commanding a smaller price than the Samsung Galaxy S10, or even the S10E. It's a fantastic deal.

The Huawei P30 has the same processor as the Huawei P30 Pro. The photos it takes are comparable to those taken by the P30 Pro. Unlike the P30 Pro, it has a headphone jack. If the smaller P30 has similar photographic clout and a slick design of its own, is there any reason to opt for the more expensive Pro?

But the P30 isn't just competing with the Pro. It's also got Samsung's new Galaxy S10E and S10 phones to worry about. Here it's a clearer choice: Do you care more about your phone's camera or your phone's performance? If the former, the P30 is for you.

That ultimately depends on your taste and how much cash you're willing to spend on a phone. The 6.1-inch P30 is palpably smaller than the 6.47-inch Pro, so large-handed people who prefer the phones like the iPhone Max will feel less comfortable here. (2,340x1,080-pixel, Full-HD displays.) The P30 also lacks the Pro's curved display, wireless charging and, in exchange for the headphone jack, true water resistance. (It's splash proof, not waterproof.)

The P30 Camera: Time to take flight

The P30 Pro takes the Mate 20 Pro’s rear-camera kit and adds a fourth, time-of-flight (ToF) camera below the flash.

Outstanding cameras have been Huawei's brand identity since 2016, when it partnered with German photography studio Leica to produce one of the first dual-camera phones in the P9 - that’s what the P stands for, after all. Three years later, the P30 Pro now has the tech world agog with its quad-camera setup. Don't count out the P30, though. While it "only" has three rear cameras (and no dedicated 5x optical periscope zoom lens), the day-to-day pictures you take on the tricamera P30 look almost identical to those taken on the P30 Pro.

That is to say, really freaking good.

The ToF camera uses infrared beams (and the time it takes them to return) to measure distance. Add that to the triple camera setup and you get the ability to adjust the depth of field of images after capturing them, along with variable or multi-layer bokeh photo effects (in other words, the bokeh of something near will look different to that of something far away, as it doesn’t with a DSLR, rather than the single treatment of bokeh mobile cameras usually serve up).

Like the Mate 20 Pro, the P30 Pro includes a 40MP primary camera, a 20MP ultra-wide, and an 8MP telephoto. The main camera uses Huawei’s new SuperSpectrum sensor - which the company says is physically larger than the sensors found in Apple or Samsung’s latest handsets - and it ‘sees’ RYYB (red, yellow, yellow, blue) light instead of the typical RGB (red, green, blue), enabling it to capture a wider range of colours for richly detailed images and, Huawei claims, making it particularly great in low-light conditions.

With the addition of a 32MP front-facing camera for unnecessarily high-quality selfies, it seems like the Huawei P30 has the best camera setup on the market (other than the P30 Pro, which offers a 50x zoom and an additional ‘time-of-flight’ depth-sensing camera for better bokeh shots).

And even if the P30 had the best photographic capabilities in the world, there’s a lot more to a phone than its camera – it delivers in terms of the other key features we expect from a flagship device, and overall performance. It has 6GB of RAM and an impressive Kirin 980 chipset, with a chunky battery providing plenty of juice. It has great specs and a beautiful design. The Huawei P30's larger sibling in the P30 Pro, has a few advantages over the P30 – it has that extra ‘time-of-flight’ depth-sensing camera for even better pictures, a larger display, and IP68 water and dust resistance; but it also costs more, so you’re going to have to consider if those features are worth the extra outlay.

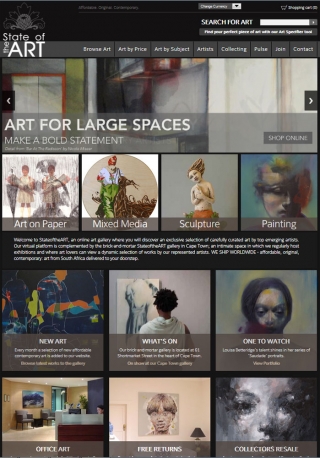

StateoftheART Launches New Website

Cape Town based StateoftheART, an innovator in the online art world, has been showcasing and selling affordable contemporary art by emerging artists since 2010. This month they launched their new website to support the keen interest in South African art, bringing their works to a global audience with easy access via the web.

The recent boom in the online art trade, currently valued at around R28bn is forecast to more than double by 2018. At least 71% of art collectors have now purchased artwork online according to the 2014 Hiscox Online Trade Report , with that number expected to rise. StateoftheART founder Jennifer Reynolds says "We want to offer our visitors the personal touch and intimacy of a gallery setting, without the limited selection associated with a physical space. More than half of our customers use a mobile device to browse our online art gallery, perhaps because there is something particularly satisfying about viewing art on a tablet as the tactile experience of holding the device feels almost the same as picking up a painting to look at it more closely."

The great advantage of StateoftheART is that it affords visitors to the site the opportunity to discover and buy affordable fine art that would not otherwise be easily found. The slick and easy to use website allows visitors to browse and buy high quality art in the comfort of their own home, making contemporary art even more accessible. Works can be bought directly from the website and delivered anywhere in the world. The site offers a 7 day money-back guarantee. To discover the world of StateoftheART, please visit www.stateoftheart-gallery.com

About

StateoftheART is South Africa's premier online gallery where you will discover an exclusive selection of carefully curated art by top emerging artists. Our virtual platform is complemented by the brick-and-mortar StateoftheART gallery in Cape Town; an intimate space in which we regularly host exhibitions and where art lovers can view a dynamic selection of works by our represented artists.

For images, information and interviews with Jennifer Reynolds, e-mail This email address is being protected from spambots. You need JavaScript enabled to view it.

FinScope South Africa 2014 shows increase in financial inclusion

Johannesburg - 18 November 2014 - For immediate release

FinScope South Africa 2014 shows increase in financial inclusion

FinMark Trust released the results of its FinScope Consumer South Africa 2014 survey results on 4 November 2014. The FinScope Survey, developed by FinMark Trust, is a research tool to assess financial access in a country and to identify the constraints that prevent financial service providers from reaching the financially under- and unserved people. The FinScope Survey is a nationally representative survey of how individuals source their incomes and how they manage their financial lives. It also provides insight into attitudes and perceptions regarding financial products and services. FinScope South Africa involved a range of stakeholders engaging in a comprehensive consultation process, thereby enriching the survey. To date, FinScope Consumer Surveys have been conducted in 19 countries. The study was based on a nationally representative sample of 3 900 adults who are 16 years or older.

Highlights from the survey Overview of changes in the past ten years

The survey results show an increase in access to infrastructure in 2014 with more adults having access to electricity (82% in 2004 to 94% in 2014), tap water on property (increased from 67% in 2004 to 81% in 2014) and flush toilets (increased from 55% in 2004 to 64% in 2014). An improvement in the standard of living is indicated by the decrease in LSM 1-5 by 4.4 million since 2004 while LSM 6-10 increased by 12.2 million people since 2004. Working and unemployment status of individuals has not changed much over the past ten years with 9 million people (22%) unemployed in 2004, and 9.5 million (23%) still unemployed in 2014. The usage of cellphones has increased to 33 million up from 12 million in 2004. Although there is an increase in the salaried adult population in 2014 (7.2 million in 2004 to 12.4 million in 2014), there is also an increase in dependence on government grants (19% in 2004 to 30% in 2014). 78% of the adult population earned an average personal monthly income of less than R2 000 per month in 2014. However the number of adults with no personal income decreased from 4.1 million in 2013 to 2.7 million in 2014.

Increase in financial inclusion

This year’s survey results indicate an increase in the number of financially included adults from 17.7 million in 2004 to 31.4 million in 2014. Banking increased from 46% in 2004 to 75% in 2014. The overall increase in financial inclusion from 61% to 86% over the past ten years is mainly driven by an increase in banking with more people accessing banking products driven by organic banking growth and SASSA roll out. Although an increase in banking is noted in 2014, the survey shows that the rate of growth in banking has dropped as indicated by bank account product usage remaining static at 75% for both 2013 and 2014.

Transactions

One of the determinants of deepening financial inclusion is the ability of South Africans to use transactional accounts to purchase/make payments for goods and services and electronic fund transfers. The study shows that 27.2 million adults have transactional products, and only 12.9 million adults use EFT or bank card payments at least once a week or monthly. Almost 100% of the banked population have transactional products.

Savings

The study reveals that 7.3 million (20%) adult South Africans have savings products with formal financial institutions in 2014. Whilst the majority of those who are saving possess long-term savings products, it is a concern to note that only 44% of the salaried individuals have long-term savings or retirement products. The contribution towards pension funds has decreased since 2013 from 4.8 million (13%) to 3.9 million (11%) in 2014. This could be the effects from the perception or “talk” that the government will nationalise pension funds and other uncertainty surrounding Government Employees Pension Fund (GEPF).

Credit and borrowing

According to the survey, 13.7 million people have formal credit products in 2014 compared to 13.9 million people with formal credit products in 2013. While secured loans are on the increase, the increase in unsecured loans, at 40%, are mainly used for developmental purposes such as child education, building/extending homes and investing in business. Use of personal loans from a bank is on the increase with 1.6 million people in 2014 compared to 1.2 million in 2013. The study shows that 2.7 million people have a credit card in 2014, a drop from 3.1 million in 2013. 36% of adults have formal credit facilities from non-bank financial institutions which could be in the form of store cards, hire purchase (HP) credit, cellphone contracts and outstanding balance for a service offered. The survey indicates that borrowing from family and friends is on the increase at 3.7 million in 2014 up from 1.8 million in 2013. Of the 56% of the adult population who do not borrow, 32% cited not having a job as a reason for not borrowing, while 31% did not want debt and 20% claim that they cannot afford to borrow. The study reveals that 4.9 million people are showing signs of over-indebtedness, an increase from 4.7 million in 2013. 1.9 million people have applied to have their debt rescheduled and 1.4 million have had a garnishee or emolument order, while 2.2 million people have considered cancelling insurance and investment policies in order to pay back borrowed money.

Insurance – are South Africans over-insured with funeral cover?

While some growth has taken place in the insurance sector with 60% of adults having insurance, a significant increase has occurred with burial society membership at 32% in 2014 up from 20% in 2004, and formal funeral cover doubling at 33% in 2014 up from 15% in 2004. The increase in burial society membership is also evident from 25% in 2013 to 32% in 2014. 40% of adult South Africans do not have any kind of financial product covering risk with lack of affordability cited as the main barrier to uptake. The results show a decrease in formal insurance uptake from 7.8 million in 2013 down to 7.1 million in 2014.

Increase incidence of remitting through supermarkets

The incidence of remittance within South Africa increased from 20% in 2013 to 23% in 2014. According to the survey, 85% of remittances are conducted monthly with an increase by 22% in remitting through a supermarket (an increase from 1.8 million in 2013 to 2.2 million in 2014), while remitting through cellphones has increased by 15% (up from 1.3 million in 2013 to 1.5 million in 2014). Remitting by banks only increased by 4.2% in 2014 (an increase from 2.4 million in 2013 to 2.5 million in 2014).

Mobile money – Do South Africans find technology complicated?

There has been a substantial increase in the usage of cellphones since 2004, with 33 million adults using cellphones in 2014 up from 12 million in 2004. However, despite the increase in usage of cellphones at 90% in 2014, only 24% of the adult population use cellphone banking. Cellphone banking only increased from 8.3 million in 2012 to 8.6 million in 2014. Over one third of adults in South Africa find technology complicated to use for financial activities according to the study.

Are consumers beginning to understand their rights and responsibilities?

Consumer protection and financial education are fundamental to the financial inclusion agenda of South Africa. An environment of poor financial literacy, coupled with a lack of adequate consumer protection, is likely to encourage consumer abuse and inappropriate use of financial services. Users of financial services can easily be victims of unfair treatment by service providers, which is sometimes caused by opaque disclosure or nondisclosure of costs or conditions. However, FinScope 2014 reveals that about 4 million banked adults have switched banks in the past 12 months prior to the survey. Reasons for switching banks could be related to 55% of the adult population claiming to understand the benefits of banking products.

Conclusion

Overall there are 10 million unbanked people in South Africa. The survey showed that while savings is difficult due to low levels of income, most people prefer to save at home possibly due to high banking fees and a lack of confidence in the financial services sector. Although unsecured loans are on the increase, 40% of these are being used for developmental reasons. Funeral cover seems to be the most popular insurance taken by most South Africans. The number of excluded people has dropped to 5.3 million in 2014 from 5.7 million in 2013. 48% of those that are excluded reside mainly rural traditional areas. The challenge for financial institutions is to bring appropriate affordable services to those who are not banked.

FinScope

FinScope was launched in 2002 by FinMark Trust (www.finmark.org.za). Its purpose is to establish credible benchmarks on the use of, and access to, financial services in South Africa. It is designed to highlight opportunities for innovation in products and delivery. The FinScope survey is a comprehensive and national representative study on financial inclusion, looking at how people source their income and manage their financial lives. It has been implemented in 19 countries (11 in SADC, 5 non-SADC Africa and 3 in Asia). The FinScope survey is currently being implemented in 3 more countries in Asia and 4 in the SADC region (1 first cycle and 3 repeat surveys).

Editorial contact: FinMark Trust Nitha Ramnath (Ms) Communication Manager

Tel: 011 315-9197 / 0829214769 Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

About FinMark Trust

FinMark Trust, an independent trust based in Johannesburg, South Africa, was established in 2002, and is funded primarily by UKaid from the Department for International Development (DFID) through its Southern Africa office. FinMark Trust’s purpose is ‘Making financial markets work for the poor, by promoting financial inclusion and regional financial integration’. FinMark Trust does this by conducting research to identify the systemic constraints that prevent financial markets from reaching out to these consumers and by advocating for change on the basis of research findings. Please visit www.finmark.org.za for more information.

Website: www.finmark.org.za

Dial out with your business phone number using an app on your smartphone

Voys Telecom, a VoIP and Hosted PBX provider, launches the Voys app. An application that enables one to dial out with a business telephone number while using ones smartphone to make the call. The Voys app enables businessmen and women to maintain a professional image when making business calls outside the parameters of the office. The app is available for free download for iOS and Android phones.

The new app is suitable for businessmen and women on the go, or who work remotely. When you use the app to make a call on your smartphone, the person being called gets to see your company number and not your mobile (private) number. It even works when a broadband internet connection is not available as the app uses the cell phone provider’s voice network to make the call.

Because the app is integrated with the business number of the user, all calls handled via the app are visible in the app’s call log. Calls made on the desk phone are also visible on the app. In addition, the user’s personal contact list - found on the smartphone - can be imported and used. Reimbursements of cell phone calls are a thing of the past as all call costs are billed directly to the business.

Voys considers calling over a 4G connection in conjunction with a Cloud-based PBX to be the future of business telephony. Therefor the next update of the app will enable users to call via a 4G connection. The app’s source code is available under an open source license which can be accessed on Github (http://www.github.com/voipgrid). Thus making it possible for anyone to contribute towards the further development of the app.

Clients of the service provider can download the app for free in the App Store and Play Store for their iOS and Android smartphones. Those interested in either using the Voys app or Voys Telecom in general, can get in touch with the service provider by sending a request via their website www.voys.co.za.

Mobile Community QEEP grows even faster than online communities Facebook and Myspace

Today qeep breaks through 2,000,000 users with a growth rate of 100% since February 2009, with South Africa taking the lead.