Adopt-An-SME takes SME ecosystem to new heights

The Adopt-An-SME programme is ticking off all the right boxes when it comes to developing South Africa’s SME ecosystem, close to a year since its launch.

Championed by accounting firm, SME.Tax, fintech innovator SME Snapshot and consulting firm, Decusatio, the 12-month program supports a group of entrepreneurs to use technology and networks to growth their businesses.

“Our goal is to create an ecosystem of better managed small businesses. We are building reputable businesses that will be the benchmark of doing business in the SME landscape,” says Tyronne Nel, founder of SME Snapshot.

Marc Ashton, founder of Decusatio adds that one of the biggest challenges facing small businesses and Enterprise Development beneficiaries in South Africa is failure to break into the market and find those valuable first clients.

“We believe that by capacitating these SMEs with our team, we will help them elevate from just working in their businesses to working on their businesses,” says explains.

The programme provides strategic business content, tools and resources that enable SME owners to unlock the growth potential of their businesses.

“Before any work begins all business owners get put through an intensive Statutory, Regulatory and Financial appraisal. We also spend some time highlighting any deficiencies before getting into the solutions,” Ken Brown, director at SME.Tax highlights.

Tebelo Ramaboea founder of Capital Projects and Investment declares that the programme helped him turn around his struggling business.

“We have been so fortunate to get courses that are designed to upskill entrepreneurs in all spheres of business, starting from understanding the fundamentals of business 101, cash flows and sales,” Ramaboea explains.

Entrepreneurs also gain one-on-one mentoring sessions, monthly skills workshops as well as secretarial support to help get their business systems going. A resource that Andile Vilakazi, founder of Drone Eye Technology, says was invaluable for his business.

“Participating in the programme has expanded my horizon when it comes to running my business and understanding my role in it. The lessons are insightful from business ideation stage to getting a system going, where your business can continue to run even if you are not there,” Vilikazi says.

Drone Eye Technology is currently at the final stages in two different SME competitions - eKasiLabs lead by The Innovation HUB and Gauteng Accelerator Programme as well as the ‘Driving Force for Change’ support initiative by the Department of Environment, Forestry and Fisheries - the award ceremonies for both will take place on the 26th of November 2021.

“I strongly believe that the Adopt-An-SME programme played a vital part in pivoting Drone Eye Technology to where we are now. The knowledge and technology we have access to helps us focus on growing our business and not just running it,” Vilakazi exclaims.

Corporates looking to support a SME can sign up on the website SME. Tax or send an email to This email address is being protected from spambots. You need JavaScript enabled to view it. , This email address is being protected from spambots. You need JavaScript enabled to view it. or to This email address is being protected from spambots. You need JavaScript enabled to view it.

Planning to access the R4.8bn in DTIC incentives?

Authors: Zahra and Nadia Rawjee, Uzenzele Holdings

If you are considering accessing development and funding grants or incentives out of the Department of Trade, Industry and Competition (DTIC) to fund your industrial expansion, you are going to have to have to put a lot of effort into your application.

The DTIC budget for Grants and Incentives has been cut by roughly 20% to R4.8bn and this means that entrepreneurs looking to fund industrial projects are going to have to tick a number of boxes to ensure their applications are successful.

As an organization that is assisting a number of industrial and manufacturing businesses to access these incentives, these are a couple of areas we believe entrepreneurs should be focusing on:

Timing is everything:

Do not start investing or committing funds until the submission and approval for the project has been received. While we all want to break ground on our projects, jumping the gun might end up prejudicing your ability to access the grant funding.

Focus on localisation:

A key learning from 2020 was that the South African economy had failed to develop local capacity and was vulnerable to interruptions in global supply chains. The DTIC is looking to see a development in local capacity and suppliers and this will be a key consideration in getting approval for your project.

Align with industry Master Plans:

Government is trying to be more strategic around the sectors that it supports and aims to grow. The roll out of various sector or industry Master Plans with specific incentives attached to them part of this strategy. The automotive sector for instance has been a major beneficiary of this approach and organisations were able to align with these have already been able to access nearly R3bn in incentives.

Social returns and impact will be measured:

While the project must make commercial sense and be bankable, there is a focus on social impact as well. Is there the opportunity for job creation in the area in which you work? Will the local community enjoy access to new infrastructure?

Quality management teams are essential:

With a smaller pot of funding available, the quality of your management team will be under scrutiny. Have your team previously worked on projects of this nature and are they co-invested in the projects?

Export earning potential and co-linkages with FDIs:

The DTIC recently released its first ever report into the Black Industrialist Scheme (BIS) and one of the key focus points for this incentive is the ability to back businesses that can generate export revenue or attract co-funding through Foreign Direct Investment initiatives.

Access to finance remains a key challenge for entrepreneurs looking to grow their business and this challenge has been compounded by the impact of COVID-19 with funders having reduced risk appetites. Ultimately grants and incentives out of the DTIC and other industry bodies can close part of this funding gap but entrepreneurs, corporates and project owner’s need to ensure they come with a bullet-proof plan to ensure that the funds will be correctly deployed.

Founded by sisters Zahra and Nadia Rawjee in 2010, Uzenzele Holdings (UH) is a niche consulting firm with over 60 years of combined experience in business development capital raising and accessing governmental funding.

What we learnt from our “Meet The Management” investor series

Author: Ane-Sonet Bresler, Problem-Solver at Decusatio

One of the most exciting projects we have worked on in the last 12 months has been a series of investor webinars allowing retail investors the opportunity to interact with the management teams of JSE and ZAR-X listed businesses.

For those who follow the South African listed equity market, you will know that one of the biggest challenges that the industry faces is a lack of coverage of businesses that fall outside the top 100 on the JSE while the ZAR-X is still in its infancy in terms of retail investor adoption.

We wanted to play our part in developing the retail investor ecosystem in South Africa and set out to interview the management teams at some of the businesses that didn’t always get media or analyst coverage.

On the JSE front, we hosted the likes of Afrimat, Renergen, Purple Group, Capital Appreciation, 4-Sight Holdings and Calgro M3 while Dale Capital Group and Orion Real Estate represented the ZAR-X.

These are some of the learnings we had from this series:

Retail investors want to engage

We often hear that there isn’t a retail investor culture in South Africa but we would beg to differ. The EasyEquities team are now reporting over 860 000 clients on their platform and we could regularly attract between 100 and 200 investors to the sessions and if management teams can work out how to engage this investor base, it represents a very real catalyst for their share prices.

Management teams need to get better at telling their story

Executives like Stefano Marani (Renergen) and Charles Savage from Purple Group have embraced social media and been open to engaging in discussions with retail investors on platforms like Twitter. In the South African context, they are more the exception than the rule.

While not every CEO is / will / or should be as charismatic as Elon Musk management teams like those behind Purple and Renergen invest a lot of time and energy inviting shareholders to see their operations, meet their people and create an engaging story behind their business.

The competition for investor capital and attention is fierce: Retail investors can just as easily put their money in Tesla or a Section12J as they can in Purple – if your intention is to build wealth through share price appreciation, then invest some time and energy here.

Staff and suppliers want to be shareholders

While they may not carry the same perceived weight or importance as asset managers and other institutional investors, we were quite surprised by the number of staff who registered for the sessions and how often key suppliers would also enjoy engaging with the management teams.

It might sound like a “soft” element but the events of 2020 have highlighted for many people just how dependent they are their employers or key clients for long-term sustainability.

By creating an investor mindset amongst these key stakeholders, you make them part of the highs and lows of your business.

International investors haven’t written off South Africa

One of the surprising stats out of our analytics was that almost 20% of the delegates who registered were from outside of South Africa. Destinations included Mauritius, US, UK, Portugal, Australia, Canada and China.

It is too simplistic to say that foreign investors are not interested in South African equities – we need to get better at marketing our value proposition.

It’s not just about the numbers

Many listed South African businesses are very one-dimensional in how they engage their shareholder base. Every 6 months they roll out their financials results and they say “we [hopefully] made some money here” and “here is your [if you’re lucky] 1% dividend yield because the operating environment is uncertain and our share price has gone nowhere”.

For us, it was fascinating to see the number of organization who were nervous about participating because they were uncertain about the questions that might come up or even asking us if they can vet the RSVP list before going ahead with their presentation.

While we are happy to acknowledge that they operate in a regulated environment, there is a concern that executives err to far on the side of caution.

Ultimately, our approach to the South African small and mid-cap equity markets need to be reimagined.

Venture capital funds, fractional investing and increased offshore allowances mean that local investors have a plethora of opportunities and the entire ecosystem needs a re-think on how it drives investor activity.

Ane Bresler is a Problem-Solver with Decusatio, a South African consulting company which assists entrepreneurs tackle the twin challenges of “Access to Finance” and “Access to Markets” and she headed up the recent investor webinar series. She can be contacted on This email address is being protected from spambots. You need JavaScript enabled to view it.

Durban Kids Launch Their Own Online Store

Siblings Gianna, Kenley and Danica McIntosh aren’t your average kids – they just launched Kidpreneurs, a handmade Bath Bomb business at 8,6 and 5 years old. These Durban kids were born in the Middle East and arrived in South Africa in 2015, and are groomed for business by the parents.

After a successful launch at their local shopping complex in Queensburgh, Durban, the siblings are being bombarded with bulk custom orders for Christmas, as well as orders for bath bomb party favours. Their online store, www.kidpreneur.online was set-up so that their bombs could be sold to South Africans across the country. Their booming business sells handmade bath bombs that transform your bath into a luxurious spa experience by fizzing and releasing essential oils and fragrances. In addition to bath bombs, the McIntosh siblings make Shower Steamers, which you place in the corner of the shower and as hot water splashes on the steamer, essential oil fragrances are released. The McIntosh siblings hope to see their products being sold in major stores across South Africa.

8-year-old Gianna hopes to be a property developer when she is older. 6-year-old Kenley hopes to be a builder, while the youngest sibling Danica wants to own a bakery. These money-savvy kids plan to invest their business proceeds to fund their tertiary education. One thing is for sure….with a strong entrepreneurial foundation, these kids are destined for greatness!

Curious about the profitability of your competitors?

As an entrepreneur, there is an inherent curiosity about the financial performance of industry peers. Is your sector expanding or contracting? Are your peers seeing growth? Short of interrogating financial data of listed businesses, there are limited tools available to entrepreneurs to access this data in an affordable manner.

This is the key opportunity that the team from SME Snapshot are tackling.

“One of the major issues facing the South African economy is the lack of real-time data, especially when it comes to the SME sector,” says Tyronne Nel, Director at SME Snapshot. Nel point out that this lack of real-time data impacts the entire SME ecosystem including lenders, incubators, accelerators and business owners.

“Think about the construction sector for a moment – we know there has been a significant increase in the number of projects out to tender and we know that SANRAL is planning to issue over R40bn in road-building tenders over the next 3 years. Yet I challenge you to find a lender who is prepared to go and fund SMEs or contractors in this construction sector at the moment – the lenders are incredibly risk averse because the entire construction sector is perceived to be high risk from a lenders perspective.”

The SME Snapshot solution

In response to this lack of data in the sector, the SME Snapshot tool was developed to begin capturing real-time data around each of the sectors.

“Initially, we started off using the Snapshot tool to support our accounting clients,” says SME.Tax Master Franchisor Ken Brown adding: “Snapshot provided our clients with an interactive dashboard showing them all the critical numbers that would be important to lenders – all we have to do is upload the accounting data and then track the key metrics.”

For clients who are not using an automated accounting system, they can upload their trial balances manually.

Some of the key features of Snapshot include:

- Aggregated sector data allowing businesses to compare their financial performance against peers through the SME Index ™

- Management of deadlines like VAT, Income Tax, Annual Returns and Compensation Commissioner

- Key metrics like profitability and margins can be tracked

As the dataset began to grow, Nel and Brown realized they had a powerful asset on their hands. The tool is now being used by a variety of different players in the SME ecosystem including lenders and incubators and they are presently piloting a project with the Innovation Hub in Pretoria.

“The SME Index ™ allows organisations to then compare their financial metrics against industry and sector peers and spot downturns or improvements in real-time,” says Nel. With the South African SME ecosystem devoid of real-time data, SME Snapshot provides a powerful solution for all role players and is now eyeing international expansion.

Get ready for your ACCA exams: How to Tackle your ACCA Advanced Taxation UK exam

At a recent online conference, a team of ACCA experts who are involved in reviewing and marking ACCA exams offered their insights on the Applied Skills, Strategic Professional and Options (UK tax) exams. The conference provided a unique opportunity for Approved Learning Partners, like IBTC, tutors and other strategic partners to come together, network, and gain practical insights into ACCA’s examinations.

During the conference they reviewed the 2018 September and December exams to provide students with direction and guidance when writing their exams this year. Here is what they had to say about The Advanced Taxation- UK

According to the examiners, there are a few changes in the ATX UK subject. The technical changes you need to be on the lookout for are the following:

- Deemed domicile changes for personal taxes (IT, CGT and IHT)

- Changes to corporate loss relief

- Income tax implications of lump sum payments

- Changes to SSE conditions

Apart from these changes, the examiners found that there are several areas that students struggle in and definitely need to improve on.

"Candidates need to consider the scenario given before they start writing their answer and not simply state general tax rules. A lot of students make this mistake. Students need to understand that each client has their own set of circumstances, which the tax rules must be applied to. Each scenario is unique and must be treated as such," said the examiners.

The examiners gave the following advice:

- Slow down

- Note initial thoughts and plan

- Think, then write

- Think, then calculate

- Clearly address the requirements and be specific

- Provide clear, short and concise explanations

- Avoid irrelevant explanations/calculations

- It is suggested that students spend 1.8 min per mark

About International Business Training College

IBTC is a registered course provider delivering classroom tuition and distance learning courses for internationally recognised professional qualifications, such as CIMA, ACCA, CAT, ICB and CFA - offering a combination of distance learning and classroom courses designed to prepare students for their professional examinations.

Operating from Cape Town since 1995, IBTC provides classroom courses in major cities around South Africa and a comprehensive Home Study programme supported by experienced international tutors.

All our courses include a complete set of internationally acclaimed study material which has been developed to ensure that students have maximum control over what they learn, the way they learn it, and the pace at which they work.

IBTC also works closely with a variety of professional institutions to support skills training and education. We believe in providing local students with access to international qualifications, bringing you closer to your professional goals and success in the workplace.

IBTC’s role is to support students in the accounting and business management field in successfully completing their exams.

Courses include:

- CIMA - Certificate, Operational, Managerial, Gateway Assessment, and Strategic Level

- ACCA - Fundamental & Professional Level

- FIA - Introductory, Intermediate, Diploma and Certified Accounting Technician Level

- CFA - Level 1 – 3

- ICB ACCOUNTING - Foundation, Intermediate, Upper Intermediate & Advanced Level

- ICB ADMINISTRATION - Foundation, Intermediate & Advanced Level

MOBILE PHONES ARE REPLACING BANK ACCOUNTS IN AFRICA

It doesn’t look like the hub of an online bank. But that’s what the yellow and blue metal kiosk becomes when Albert Agane locks himself behind the metal bars every day at 6am.

From his perch along a dusty suburban thoroughfare in Accra, the 28-year-old helps fellow Ghanaians withdraw or deposit cash for accounts they operate from their mobile phones. All they need do is text.

Mobile money is the fastest-growing source of income for wireless-network operators like MTN and Vodafone’s Safaricom unit, outpacing data since many Africans don’t have the latest smartphones. They need agents like Agane because ATMs and bank branches are out of reach, or too costly. “In a village, where there are no banks, you can go to an agent and transact,” said Agane, who earns a commission of about 1% for moving as much as 20 000 cedis ($3 700) a day.

“Once people have phones there’s no need for a bank account.”The service has become an indispensable part of how Africa’s 1.2 billion people live, from buying funeral cover to borrowing money. The number of registered users in Ghana soared 11-fold between 2013 and 2017, International Monetary Fund data shows. Across the continent in Kenya, where it was pioneered, the value of such transactions amounts to almost half of gross domestic product, according to the World Bank.Sub-Saharan Africa has more mobile-money accounts than anywhere else in the world with about 396 million registered users at the end of 2018, a 14% increase from a year earlier, according to the GSM Association.

As it catches on around the world, South Asia saw 29% growth in 2018, and it was 38% for East Asia and the Pacific.“There are a lot of partnership opportunities with immense revenue potential for both mobile-network operators and banks,” said Patrick Quantson, head of digital transformation at the Accra-based unit of Standard Bank, Africa’s largest lender. “The mass appeal of mobile-money services and the mode of delivery also presents an opportunity to scale financial products to all market segments, at incredibly lower costs.”

It’s easy to see why Agane-one of 182 000 mobile-money agents-is busier than the ATMs around Ghana’s capital city. There are more than 1 740 such outlets per 100 000 people in the country, compared with only 11.7 ATMs and 8.7 bank branches, the IMF data show. “We’ve seen that people in the informal sector, who would have kept their money under pillows, move into mobile money,” said Eli Hini, general manager for mobile financial services at MTN Ghana, which controls about 78% of the active-customer market.

“Now, when there are floods people don’t lose their money. They’d rather get interest paid on it.” Banks don’t lose out because the mobile-phone companies park deposits with them, giving them cheaper access to funding.MTN and Sanlam, Africa’s largest insurer, last month announced that the continent’s biggest wireless network operator will offer funeral and other life-cover products through its digital channels spanning 237 million subscribers in 21 markets. Vodafone’s Johannesburg-based Vodacom Group last year bought a stake in Safaricom, based in Nairobi, from its parent to gain access to its M-Pesa money-transfer service, helping to double earnings from financial services. Vodacom last year made 11 billion transactions worth R2trn to 36 million customers.

The potential stretches to Nigeria, Ethiopia and Egypt, where reforms could add 110 million mobile-money accounts in the next five years, the GSM Association said in February. There’s more to come, said Martison Obeng-Agyei, who heads Vodafone Cash in Accra. There were about 31 million mobile-voice subscriptions in the country of 29 million people, and 12.1 million active mobile-money accounts at the end of 2017, from just 345 400 five years ago, Bank of Ghana data show.

“There’s huge prospects,” he said. “One of the things that was lacking in our financial system was the ability to move funds around. Businesses have been established because of mobile money.” While Agane hasn’t been robbed in his four years as an agent, he stays alert. A company comes around to exchange hard cash for electronic money to lower the chances of being targeted, like a vendor Agane heard of across town, who was attacked with a cutlass.

“There are so many risks,” he said, especially with the kiosk open until 9pm. “But there’s no jobs. If you don’t do it, there will be no food on your table.”

Source: https://www.fin24.com/Companies/ICT/mobile-phones-are-replacing-bank-accounts-in-africa-20190813

CURRENT SA MARKETS - Time to throw in the towel, or should we hold out for a hero?

Questions that are most probably top of mind for a multitude of foreign investors is ‘Why South Africa and why now?’, and one could be forgiven for being unsure as to the answer.

It is no secret that the South African markets have been in a state of flux. In his first SONA last year, Cyril Ramaphosa promised “a major push this year to encourage significant investment in the economy”. Pivotal to this push, foreign investment from firms and individual investors outside of our borders was necessary. But, taking into account the dismal financial results reported by Moody’s in Q1 2019, will President Ramaphosa be able to make the necessary changes and reforms to help economic growth accelerate to as high as 3% by 2022?

According to the group, in a macro-analysis released at the beginning of June 2019, the odds that South Africa may experience a technical recession are high. This, in a large part, can be contributed to the widespread power outages experienced so far in 2019 that have had substantial negative ripple-effects, particularly for the mining and manufacturing sectors.

The task of resuscitating South Africa’s economy is certainly an onerous one, with the reality being that now is the time to dig deep as a country and harness all available resources. But it isn’t all doom and gloom on the investment front. With the recent ANC election win, under the leadership of Ramaphosa, hopes are high for renewed reforms that could potentially tackle the unemployment rates and provide a re-energised push to ignite growth.

Whilst financial markets are generally positive towards South Africa at the moment, an underlying sentiment that seems to be weighing on investors is whether government can effectively address the Eskom issue. After more than a decade of increasingly slow growth, and an exponential rise in joblessness, immediate policy priorities from Ramaphosa are a crucial first step to addressing South Africa’s complex economic challenges.

So, the question still remains – Why South Africa and Why Now?

The outcome of the election has been in line with market expectations and sentiment towards South African markets remains tentatively positive. The announcement of a drastically smaller, reshuffled cabinet this month is also bound to alter our economic course. Add to that Moody’s decision to skip the much-anticipated assessment of SA’s sovereign credit rating until November 2019, and it seems that for now, South African markets have been granted a reprieve, albeit a small one.

The Rand is expected to weaken over the next few weeks both in terms of the USD and the Pound rate, but the dominant position of the South African economy on the African continent, and the liquidity of the Rand on international markets still make the ZAR the currency of choice for investors seeking African exposure.

Although things look precarious, investors shouldn’t throw in the towel just yet. A look at analysts’ consensus forecasts (according to Thomson Reuters) on individual shares (based only on price forecasts, i.e. excluding dividends and adjusted according to their weight in the index) in the FTSE/JSE Top40, shows that analysts still expect the Top40 Index to be trading 21.6% higher from current levels (48 465 as at 28 May 2019).

As the famous John Templeton said, “Bull markets are born on pessimism, grown on scepticism, mature on optimism, and die on euphoria. The time of maximum pessimism is often the best time to buy, and the time of maximum optimism is often the best time to sell.”

Sources:

https://businesstech.co.za/news/finance/321905/high-chance-of-recession-in-south-africa-moodys/

https://www.fin24.com/Economy/moodys-delay-is-good-news-for-the-rand-say-analysts-20190330-2

https://www.moneyweb.co.za/news/economy/the-rand-isnt-sas-share-price-anymore/

https://www.fin24.com/Finweek/Investment/is-now-the-right-time-to-sell-your-shares-20190605

A THIRD CONSECUTIVE WIN FOR BEST PERFORMING BROKER IN AFRICA

Winning the award for “Best Performing Broker in Africa” by International Business Magazine is truly a prestigious achievement in a much sought after category. Winning it 3 years in a row is unprecedented. With its 3rd consecutive win, CM Trading, an award-winning online trading company with a reputation for out-of-the-box approach to investment opportunities and the leading provider of derivative trading solutions to the local and international market, has cemented their standing across global platforms as an African force to be reckoned with.

Daniel Kibel, Director, CM Trading says, “Although this is something that have won in the past, an award of this nature is recognition of the amazing work that each and every one of our teams is doing each every day to push CM Trading forward. It's a great honour to have been awarded Best broker in Africa for the 3rd year running. What is even more satisfying is that we were voted by the public. So, thanks to everyone who helped us get there.”

The awards presented by International Business Magazine are distinct, pan-African business and capital market investment awards that are recognised globally and reward the achievements of some of Africa’s market leaders. These awards are truly a salute to the extraordinary achievements of private sector companies across the continent. What makes these awards even more prestigious, is that they not only profile excellence in investment reporting, they also highlight the crucial need for investment within Africa.

The annual awards showcase the best of Africa’s investment success stories and the competition is fierce. To achieve this level of excellence for 3 years running, considering the calibre of those organisations competing, has set the standards incredibly high. CM Trading views this as an opportunity to dig deeper in their quest to continually provide some of the most attractive propositions for investors globally. Although the prestigious nature of this award cannot be ignored, Kibel re-iterates that a win in this category only creates an even higher drive for CM Trading to carve out their mark in the complex world of Forex trading and continue development of their unique range of products and services that make them a cut above the rest.

“With CM Trading offering clients only the very best Forex trading experience and having our commitment, our clients, our teams success and our unwavering passion for African investment recognised with this award for the 3rd time, the sky truly is the proverbial limit as to what the road ahead holds for us.” Concludes Kibel.

CM Trading is “Your local international broker” and is a leading provider of derivative trading solutions to the local and international market. The company, regulated by the South African Financial Services Board, operates successfully around the globe and assists in increasing their clients trading knowledge, providing personal service and support as well as a range of online solutions to match every traders needs.

For more information on CM Trading please visit their website https://www.cmtrading.com/, or contact them on +27 10 500 80 26 or via email This email address is being protected from spambots. You need JavaScript enabled to view it. . You can also follow them on Twitter @CMTrading_FX and Facebook @CapitalMarketsTrading.

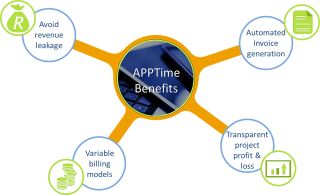

APPSolve launches new APP for small businesses in SA

PRETORIA, 25 JUNE 2019 – APPSolve has recently launched its internal management app, APPTime, aimed at eradicating challenges in businesses such as revenue leakage, project management inconsistencies, missing timesheets, outstanding quotes, incorrect invoicing, missing expenses, lack of control and dissatisfied customers. Development on the APPTime software application started almost from the inception of APPSolve 17 years ago, and has since evolved as the business has grown to cater for some significant business challenges that they believe are not unique in the South African market.

The product is available on a subscription basis in the hope of sharing lessons learnt and innovative solutions at an affordable price for small businesses. “Although it is important to have effective systems in place, they can prove to be costly in a small business where every cent counts,” explains Maureen Grosvenor, Head of Custom Applications at APPSolve. “We have learnt some tough lessons over the years and have spent time and money on innovative solutions.

We are hoping we can elevate some of the cost pressures by providing a cost-effective scalable business management system for SME’s that can easily grow as your business does. In addition to this, we also offer an efficient team of data capturers and help desk support staff that can help you and your team with all your administrative tasks. So it’s a full end-to-end business management service”.

Key features:

- Cloud Based, built to include field service environment & low bandwidth

- Mobile and Desktop APP versions for Android and iPhone

- Manage suppliers, customers, employees, contractors and applicants including cost to company and payroll

- Manage internal and external resource CV’s and skills matrix

- Manage leads and opportunities

- Manage customer and supplier contracts & multiple projects and resource allocation

- Manage billing types and schedules for example fixed, time and materials, variables, milestone based

- The ability to capture time per project with multiple entries per day

- The ability to capture employee and project expenses

- The ability to on-bill expenses to customer and integrate It with the invoicing

- Option to generate invoices per customer and project

- The ability to book and approve employee and contractor leave applications

- Message board with configurable messages

- Document upload and attachment feature (employee, contracts and expense documents)

- Notification email when time sheets are overdue

- Distance travelled logged per day

- SARS log book extract

- Export data to Excel

- Reporting per resource, project or team

- Visual representation of time captured and days not captured

- Generate PDF reports

- Integration to financial systems

- Integration to project management tools

- Integration to Telegram and Email for notifications and approvals

- Company and project profit and loss.

About APPSolve Organisations often invest in best-of-breed business systems without unlocking their full potential. The systems are underutilised, hampered by complex technical issues, or poorly aligned to business strategy.

APPSolve’s is to ensure our customers enjoy true business value from their IT investments with simplicity and value at its core. APPSolve was established in 2002. We specialise in consulting services across Oracle E-Business Suite, Oracle Cloud, Custom Software Development, integration and agnostic IT Solutions. We also offer a range of integrated solutions to perform specialised processes.

Our product range includes BeBanking, an end-to-end secure host-to-host banking solution, and AfricaTradeApp, a cloud-based supply chain management system. Our services include Solution Scoping and Design, Software Implementations, Software Support, Training, Help Desk Administration, Technical Development, Database Administration, System Administration, Virtualisation and Engineered Systems.

We also offer Project Management, System Health Checks, Value Added Reseller / License Management, Cloud services (Readiness and Implementation) and Business Process Engineering.

Follow us www.appsolve.co.za Facebook Twitter LinkedIn

Media Contact Maria Joubert for APPSolve Purple Word Box PR Tel: 061 441 4920 Email: This email address is being protected from spambots. You need JavaScript enabled to view it.