New Property Investment Crowdfunding Service Aims for Inclusive SA Wealth Development

Once the exclusive preserve of the wealthy, high-return global property investments are about to become accessible to everyday South Africans. This is thanks to a new property investment crowdfunding service. The announcement comes from Alex de Bruyn, CEO of DoshEx, a Johannesburg technology firm that runs blockchain-based DoshExchange, through which its DoshProp service is being offered.

“It’s time everyone had a shot at building their wealth portfolio without breaking the bank,” says de Bruyn. “DoshProp gives mid-income earners inclusive access to one of the world’s largest investment classes at an entry-level price.” DoshProp, along with the first of many investment opportunities to come, is available as a service on DoshEx’s DoshExchange. After registering, either through the company’s mobile app or its website, interested parties can log in and start investing immediately.

Every DoshExchange user will get the chance to invest in a luxury apartment complex for only R100 per share. The Paradiso, to be constructed in the upmarket Como district of Perth in Western Australia, promises a 20% return on investment over 18 to 24 months. However, shares are limited and are expected to be snapped up when the offer is released to global traders on 1st November.

DoshEx representatives are available online and through dedicated social media channels and online support channels to explain how the fund will be administered, how to sign up to DoshEx, how to manage one’s digital portfolio, and how participants can track the progress of the project online. Because investment is through a publicly registered South African company, Paradiso COMO Limited, the public can avoid the constraints of South African foreign trade regulations. In addition, the fund is being hosted on blockchain trading technology, which is immutable and tamper resistant. DoshEx will be partnering with Edgars Club to bring DoshProp to a wider audience.

The retail giant has recognised the potential in offering its customers this innovative approach to inclusive wealth creation. Plus, Club members will enjoy additional rewards. Says Candy Steyn, Edgars Club Head of Operations: “We are committed to constantly refreshing our mix of benefits as lifestyle needs are constantly shifting and our mission is to reflect contemporary living. We don’t simply respond. We anticipate change and new trends. DoshEx is an example.” De Bruyn says buy-in from Edgars Club is validation of the service’s relevance to today’s consumers as a lifestyle enabler.

The system may also be a refreshing change for existing crypto traders, who make up 11% of the country’s 31.18 million internet users. “For some, cryptocurrency trading may become somewhat two-dimensional over time,” suggests de Bruyn. “DoshProp is integrated with DoshExchange and welcomes bitcoin investments, allowing traders to diversify their portfolios and lock in profits.”

Crowdfunding for capital-intensive property development is likely to gain rapid popularity as it exposes developers to a massive untapped source of financing. At the same time, it opens the door to inclusive economic participation for those who were unable to do so until now. “Through DoshProp, we’re offering both groups unlimited potential to realise their goals in a mutually beneficial way,” says de Bruyn.

Visit: https://www.doshex.com/#/doshProp/howItWorks

Contact: Alex De Bruyn: 011 4685236 or mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

World IoT and blockchain first for SA’s DoshEx and Digital Twin

South African technology companies DoshEx (www.doshex.com) and Digital Twin (www.digitaltwin.digital) unveiled a world first designed to revolutionise the security and integrity of solutions deployed across the Internet of Things (IoT). IoT is the next big thing in digital connectivity whereby devices ‘talk’ to physical objects – from lightbulbs to vehicles and manufacturing plants – via a complex system of sensors.

Scalable and reliable IoT is the overriding goal of major technology players worldwide, but secure interaction between various components in these networks has proved to be a major obstacle – until now! DoshEx CEO Alex de Bruyn noted: “DoshEx is a leader in blockchain deployments while Digital Twin is an innovator in the realm of fourth-generation edge devices that provide access to enterprise networks.

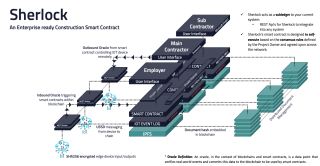

“Our collaboration enabled us to create a globally scalable solution to the problem of harnessing blockchain technology without the need for outside verification of events logged by a blockchain. We call the new product Sherlock. “The IoT nightmare is that ‘bad bots’ might create havoc in the case of cybercrime or system malfunction. Sherlock will help developers put these fears to rest.”

Richard Creighton, CEO of Digital Twin, commented: “Secure, automated and highly dependable field data is essential in achieving the next generation of cross business insight and control, we believe we’ve made this possible. It could even be a world-first. “The industry forecast is that $15 trillion will be invested in IoT by 2025. But IoT creates a multitude of technical and scientific challenges. Sherlock addresses one of the big potential snags to rapid IoT uptake by bringing together blockchain technology and edge-based connectivity in a seamless but secure manner.

“It is essential that IoT solutions enjoy public and investor confidence. Sherlock will significantly increase the level of trust and open the way for serious IoT development.” A blockchain is an immutable set of records linked together cryptographically through a series of interconnecting blocks, creating an everlasting record of transactions and responsibilities. When events are input it is necessary to verify an event actually occurred. For independent verification, a digital third-party, an oracle, is connected to the system.

An oracle, as a component of blockchains and smart contracts, is an ‘agent’ that finds and verifies real-world occurrences and feeds confirmation to the blockchain for integration into a smart contract, ensuring all parties can trust the record of events. Oracles as a data-feed and an element of multi-signature contracts have no connection with the company of the same name. However, any third-party input creates a theoretical risk the truth might be tampered with. Now, to create absolute trust, Sherlock offers a built-in oracle solution. In technical terms, DoshEx developers and Digital Twin innovators connected an inbound oracle input from an edge-capable device over a globally enabled USSD network (the global communication system used by mobile technology).

This ensures trusted and SHA256 encrypted input into a blockchain. Encryption using the SHA256 algorithm is tamper-proof. Creighton added: “By using USSD, the edge devices and their inputs can be instantly globalised without reliance on any specific local cellular provider. The edge device can travel anywhere in the globe and transmit encrypted messages into the blockchain.” The Sherlock collaborators can now build industry-specific IoT-enabled smart contracts for large value chains across multiple participants that rely on trusted data. Said Alex de Bruyn: “An example would be mining firms that have to measure quality and quantity from pit to port or a construction group that has to confirm events throughout the build process and critical milestones captured, such as field results of concrete testing, documentation sign-off and versioning, as well as key progress reached as signed off by the professional team, using an IoT-enabled biometric sensor. “The combination of IoT and blockchain will revolutionise efficiency across value chains … and Sherlock is a key enabler, locally and worldwide.”

-- ENDS --

About DoshEx

www.doshex.com DoshEx is a South African company pioneering the development of crypto-tokens and digital assets. Related DoshEx products and services include tokenised solutions for corporates and SOEs, safekeeping of funds and the design and deployment of blockchains and Smart Contracts. DoshEx’s focus is to drive the adoption of tokenised solutions at an enterprise level by implementing blockchain technology into their current business models.

About Digital Twin

Digital Twin is an industry 4.0 focused business and an indirect service provider to a network of specialist and vertical market-focused solution providers. The Digital Twin platform offers this network of specialists the ability to enhance their offering to their customer-base and enable them to deliver bankable ROI projects and services. The platform offers multiple entry points:- Tier 1 – Edge-capable hardware solutionsTier 2 - Global connectivity and data brokerTier 3 - Management console and visualisation Tier 4 - Specific value in use consultation and design Digital Twin offers unique services to its network of specialists, from standardised solutions to rapid prototyping of hardware and software as well as industry 4.0 consultation expertise.

Contact: www.doshex.com

Alex De Bruyn

Tel: +27 11 468-5236

Issued By: Tale Spin Media

Zelda Williams

082 461 0689

DoshEx rolls out Pundi X technology to enable crypto adoption in South Africa

DoshEx, the South African Digital Asset Exchange, and global blockchain-based payment pioneer Pundi X, today (4 April) announced a strategic partnership to bring cryptocurrency to high street retailers and local consumers. In a first for South Africa’s retail market, XPOS, the Pundi X blockchain-based point-of-sale devices and XPASS cards for cryptocurrency transactions are to be deployed at selected sites across South Africa in a co-branded roll-out with DoshEx. Blockchain-driven point-of-sale technology enables merchants to digitize their payment infrastructure on the blockchain while consumers transact in cryptocurrency in a fast, efficient and convenient manner. Blockchain – a tamper-proof, cryptography-based technology – establishes trust of the transactions among various parties. Cryptocurrency transaction within the Pundi X payment ecosystem is a hassle-free method that promotes financial inclusion as XPASS-holders will have their own financial history of the transactions on XPASS card and the associated XWallet app without the necessity for having a bank account. Rapid acceptance is envisaged as the process resembles credit-card transacting with which consumers are familiar. To enable crypto transacting, the XPASS is simply tapped on an XPOS device.

Zac Cheah, CEO and Co-founder of Pundi X Labs, commented: “XPOS is the easy, affordable access point into crypto for mainstream retailers and consumers. “Many big businesses already access the crypto benefits of trusted record-keeping transactions. Now, an XPASS card loaded with crypto enables ordinary people to embrace the crypto-future, including millions of unbanked South Africans. “Our partnership with DoshEx enables us to tap into the early-adopter market at pace as this Bryanston-based innovator has a proven track-record as a digital exchange and developer of blockchain-based solutions for leading corporates, including the South African arm of Virgin Money.” DoshEX CEO Alex de Bruyn noted: “It was essential to roll out trusted and proven technology as our objective is to rapidly build South Africa’s first point-of-sale cryptocurrency network. This is why we partnered with Pundi X. “This global technology player has deployed payment ecosystems in numerous markets, including developing economies such as Argentina, Brazil, Colombia, and Nigeria.. Its international representation stretches from London to Jakarta to Tokyo. Pundi X therefore has the resources to support a rapidly growing network in line with our vision of demystifying crypto and turning it into a generally accepted payment option.

“We believe XPOS will rapidly become your crypto ATM and transaction-enabler at your local coffee shop or high street store.” Adoption is easy. Participating merchants install XPOS technology on the counter and provide the XPASS cards, activated for a once-off fee. Cryptocurrency is preloaded by the vendor. Users then transact on XPASS. Alternatively, users can buy XPASS online from DoshEX at www.doshex.comand load crypto online. The XPOS strategy calls for phased roll-out of XPASS cards and devices, with 5000 cards available for the first wave of early adopters. The partners will announce details of the deployment footprint as the technology becomes available in different geographic areas. De Bruyn added: “The ability to readily transact in crypto is a vital step in digital currency development. Soon it will be the norm for the public to buy, hold and sell crypto. Borderless transactions and transfers will be easy, without the high costs traditionally associated with these activities. “In the crypto-future consumers will transact in their crypto currency of choice, perhaps linked to dollars or euro. Crypto’s future is bright and Pundi X has provided the first light switch.”

-- ENDS --

About DoshEx: DoshEx is a South African company pioneering the local development of crypto-tokens. Related DoshEx products and services include tokenised solutions for corporates and SOEs, safekeeping of funds and the design and deployment of blockchains. This digital exchange is the brainchild of a group of entrepreneurs with a background in payments and crypto-currencies. Among the innovators is Alex de Bruyn, who is young, articulate and passionate about the tokenised future. He is also DoshEx’s media spokesman. Website: www.doshex.com Contact: Alex De BruynTel: +27 11 468-5236

About Pundi X: Pundi X is a leading developer of blockchain-powered devices, including the world’s first point-of-sales (POS) solution enabling merchants and consumers to do transactions on the blockchain in physical stores. Pundi X is also the developer of the first, fully-functional blockchain phone, the XPhone. Its POS device, the XPOS, has been shipped to over 25 countries including Argentina, Australia, Colombia, Korea, Switzerland, Taiwan and the USA; 100,000 devices are being targeted for rollout to the global retail market by 2021. The company is headquartered in Singapore. Its international presence includes offices in Jakarta, São Paulo, Seoul, Shenzhen, Taipei, and Tokyo. Listed as one of the top 50 innovative fintech startups in 2018 by KPMG and H2 ventures, the company is also a member of Singapore Fintech Association, Fintech Association of Hong Kong, ACCESS, Swiss Finance and the Fintech Association. It is also a founding member of Asosiasi Blockchain Indonesia. For more information, please visit https://www.pundix.com

SA’s first specialised developer of tokenised ecosystems and exchange goes live

DoshEx, the Johannesburg-based developer of tokenised ecosystems and exchange, has formally launched following the listing of two virtual assets by two financial service companies.

The digital tokens registered and listed with DoshEx permit these pioneering enterprises to transfer value to third parties in a fast, cost-efficient and transparent manner that delivers built-in fraud protection and client peace of mind as all transactions are blockchain-enabled. Transactions logged on a blockchain are cryptography-based and tamper-proof, a key factor behind the growing international appeal of tokenized ecosystems. A third ‘tokenized economy’ is scheduled to list on the Bryanston-based exchange in the fourth quarter of 2018.

Each ‘tokenized economy’ meets unique industry needs while various reasons drive the use of these digitized assets. DoshEx, a self-funded exchange and tokenization specialist, is led by a group of South African entrepreneurs and businessmen and offers a range of services, including: conceptualization and development of tokenized solutions, customized to the unique needs of major corporates and others; safekeeping of funds through ‘cold storage’ in cold wallets, totally isolated from online networks and safeguarded through multi-signature security systems, reducing any single-man dependence and vulnerabilities; design and deployment of blockchain-enabled solutions; exchange listings on DoshEx; design and roll-out of fit-for-purpose tokenized ecosystems, with integration to traditional financial systems for ease of use.

DoshEx CEO Alex de Bruyn commented: “We took the exchange live in August and are now ready to follow up with the public launch of tokenized solutions. “Although globally proven, tokenization is still a relatively novel concept in South Africa, but we could not have hoped for a better response to our market offering, as indicated by the signing of three great customers and the delivery of our first two tokenized solutions.

“Early adoption requires a vision and a keen awareness of the benefits that accrue when instantly verifiable and automatically triggered transactions are concluded via a blockchain.” He added: “Financial service organizations have been quick to appreciate the benefits of a DoshEx listing, but awareness is rapidly growing across other sectors.” International experience indicates that tokenization spurs the further development of loyalty programmes, though the loyalty industry represents only a small fraction of the potential customer-base.

De Bruyn said major retail groups and quick service restaurant chains are well positioned to achieve efficiencies and reinforce ‘sticky’ customer relationships through the creation of tokenized ecosystems on a blockchain. Many organizations, according to the DoshEx CEO, are attracted to token-ecosystems simply because of their proven ability to slash transaction and record-keeping costs, with the benefits especially attractive to large organizations that draw on extensive supplier networks and serve wide-ranging customer groups.

DoshEx services are supported by an in-house team of blockchain developers and business process professionals. De Bruyn noted: “Feedback from potential DoshEx users indicates tokenization is increasingly seen as a tool for leveraging corporate growth and an essential building block for businesses with international ambitions. “Tokenization creates instant global reach. Cross-border remittances cease to be a constraint or a hassle-factor for customers.

Transaction efficiencies across the supply chain are also considerable while major companies are impressed by the instant auditability of blockchain-generated records – an important consideration as corporates review internal controls in light of recent accounting failures.” Though corporate interest continues to pick up, De Bruyn foresees no immediate capacity constraints. He commented: “We anticipate high future demand for tokenized solutions, but we’re confident we have sufficient capacity within our current structure. However, local skills are scarce and extensive blockchain and cryptography training is hard to come by. This could become a constraint, but not for some while yet.”

About DoshEx:

DoshEx is a South African company pioneering the local development of crypto-tokens. Related DoshEx products and services include tokenised solutions for corporates and SOEs, safekeeping of funds and the design and deployment of blockchains. This digital exchange is the brainchild of a group of entrepreneurs with a background in payments and crypto-currencies. Among the innovators is Alex de Bruyn, whose entrepreneurial credits include the launch of Waxed Mobile Payments. (He was co-founder.) De Bruyn is young, articulate and passionate about the tokenised future. He is also DoshEx’s media spokesman.

Website: www.doshex.com

Contact: Alex De Bruyn

Tel: +27 11 468-5236