Captive Insurers, Are You Ready For Sam?

Written by: MyPressportal Team Save to InstapaperJHB (Oct 2014) – Since the Financial Services Board (FSB) first published their roadmap for the Solvency and Assessment (SAM) in 2010, traditional insurers have dedicated resources to develop their systems and processes in preparation for the SAM regime. But as captive and niche insurers typically have little to no full time employees, skilled or available outsourced service providers play an important role in the development phase and providing continuous support in implementation. This begs the question of whether captive and niche insurers are keeping pace with the onerous requirements of SAM implementation.

“As a board member of a captive or niche insurer you need to be circumspect as to whether you are realistically on track to meet the deadlines contained in the SAM roadmap. The size and complexity of the insurer obviously plays a role and proportionality is taken into account by the FSB, but compliance with SAM is inevitable.

Whether the FSB or the Reserve Bank will be the one with the stick, penalties will be levelled against non-compliant companies. And ultimately the board members will carry the can for risk governance,” explains Magda Kendall, Head of Risk Advisory and Captive Solutions at Aon South Africa.

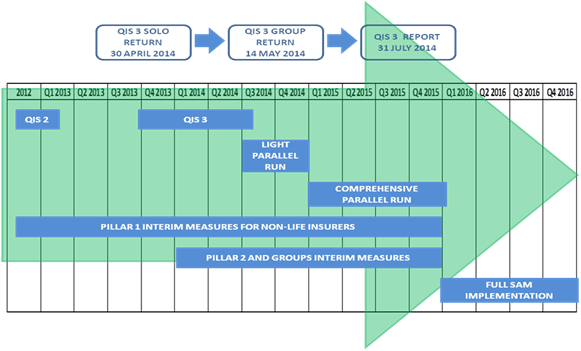

The SAM roadmap is as follows:

Pillar II – Governance and Risk management

So are captive and niche insurers doing enough, fast enough to ensure compliance with SAM deadlines?

“In our experience of completing or reviewing the Pillar II readiness assessments for 60% of the Captive insurer market, the answer six months after submission of the assessment to the FSB, is probably not”. In addition the issue of ‘Board Notice 114 of 2014 – Proposed Governance and Risk Management framework’ in September for implementation by 1 April 2015 will add to the effort required.

“By far the most important outcome of Pillar II is the ‘Own Risk and Solvency Assessment’ (ORSA) which will have to be submitted during 2015 as part of the comprehensive parallel run – and we’re fast running towards end of 2014. The ORSA isn’t a single document, nor a standard template, but the entirety of the process and procedures employed to identify, assess, monitor, manage and report risks and to determine the impact of your material risks on your capital requirements. An in depth understanding of the Standard model to determine the Solvency Capital Requirement (SCR) is required together with the impact the risks in your insurance business have on this number,” explains Magda.

Pillar I and III

The final Quantitative Impact Study (QIS) was submitted in May 2014 and the light parallel run is in full swing with the comprehensive parallel run in 2015.

The QIS forms the basis of the new reporting requirements in the form of Quantitative Reporting Template (QRTs) to the Regulator. Traditionally the short-term (ST) return was completed by accountants with limited or no assistance from an actuary. However, to complete the QRTs under the SAM regime the need to appoint an actuary has become imperative.

“An actuary’s knowledge and understanding of the standard model and ensuring the data quality is adequate - a concern of the FSB with short-term insurers, and the reason for the planned thematic review this year - should not be underestimated,” warns Magda.

As a board member you should start asking yourself some of these questions:

− Do you understand what the drivers are to determine SCR and Technical Provisions (TP) based on the QIS?

− Do you know the difference between the standard model and simplification method contained in the QIS?

− Do have a risk rating methodology and risk register to evaluate the material risks and can you project the

future impact of these risks on your SCR?

− Have you developed and implemented your risk management policies?

− How your selection of assets affected the SCR?

− Do you have a governance framework with control functions and resources to execute, monitor and report

the results of ORSA?

− Are the people that fulfil head of control functions qualified and experienced to provide assurance?

− Have you embedded the results of the QIS3 to prepare for the SAM parallel runs?

− Are you comfortable that you have the right resources to complete and submit the QRT’s?

“If your answer is ‘no’ to some of these questions, it could mean that you might not be ready for implementation and the fast tracking of your activities is critical,” concludes Magda.

Get new press articles by email

We submit and automate press releases distribution for a range of clients. Our platform brings in automation to 5 social media platforms with engaging hashtags. Our new platform The Pulse, allows premium PR Agencies to have access to our newsletter subscribers.

Latest from

- 7 Business Trends Your SME Can Leverage In 2026

- Sadilar Amplifies Visibility And Impact During Conference Season

- Future-ready Logistics- 5 Shifts TO Watch In 2026 (SUB-saharan Africa)

- Dunlop Urges Motorists To Prioritise Tyre Safety On The Busy Joburg To Cape Town Festive Route

- Poverty Trends Report Shows National Progress But Flags Growing Challenges In Gauteng

- SDG Challenge SA 2025 Highlights The Power Of Youth Innovation In Shaping A Sustainable Future

- Experienced Industry Leader Pauli Van Dyk Named Dean Of AFDA’s Upcoming Hatfield Campus

- South Africans Keep Tourism Alive As Homegrown Travel And Local Spending Rise

- Pretoria Student Wins Global Excel Esports Competition

- AfDB Steps Up Support For Somalia With $76m Investment In Roads And Regional Integration

- Corporate Law Experts Warn Directors Of Serious Consequences For Improper Transaction Approval

- New 3% Inflation Target Begins To Shift Expectations In South African Economy

- Retail As A Development Catalyst Drives New Africa Developments’ Inclusive Growth Strategy

- Collaborative SEF Model Shows How Civil Society And State Can Rebuild Economic Trust

- Shumani Accelerates Industrial Growth With Bheka Forklifts And New Equipment Plans For 2026

The Pulse Latest Articles

- Education Is The Frontline Of Inequality, Business Must Show Up (December 11, 2025)

- When The Purple Profile Pictures Fade, The Real Work Begins (December 11, 2025)

- Dear Santa, Please Skip The Socks This Year (December 10, 2025)

- Brandtech+ Has 100 Global Creative Roles For South African Talent (December 9, 2025)

- The Woman Behind Bertie: Michelle’s Journey To Cape Town’s Beloved Mobile Café (December 9, 2025)