Cyber incidents top concern for Financial Services sector in 2024, Allianz Risk Barometer Reveals

Written by: MyPressportal Team Save to Instapaper

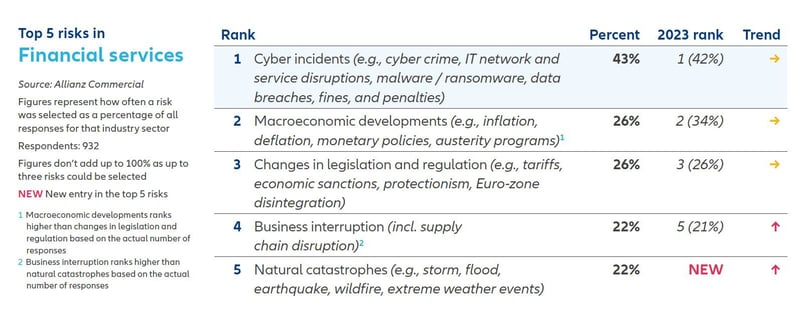

- Data breaches, attacks on critical infrastructure or physical assets and increased ransomware attacks keep cyber concerns at #1 with 43% of responses.

- Macroeconomic developments is second with 26% of responses as inflation remains one of the most difficult risks to manage this year.

- Businesses need to implement proactive risk management strategies to safeguard their operations.

Johannesburg, June 3, 2024 - The financial services sector is facing a growing threat from Cyber incidents, according to the Allianz Risk Barometer. The report highlights that cyber incidents have emerged as the primary concern for financial institutions in 2024, with 43% of respondents ranking it as a significant risk. This alarming trend is further exacerbated by the recent surge in ransomware attacks, which has seen insurance claims activity increase by over 50% compared to 2022.

The Allianz Risk Barometer, an annual survey conducted by Allianz Commercial, gathered insights from industry experts and executives across the financial services sector and other industries. The survey revealed that cyber incidents are followed closely by Macroeconomic developments and Changes in legislation and regulation, both ranking at 26%. Business interruption and Natural catastrophes also pose significant risks, with 22% of respondents expressing concern about each.

Hackers are increasingly targeting IT and physical supply chains, launching mass cyber-attacks, and finding new ways to extort money from businesses. As a result, early detection and response capabilities and tools are becoming increasingly crucial. Investment in detection backed by artificial intelligence is expected to enhance incident identification. Without effective early detection tools, companies may experience longer unplanned downtime, increased costs, and a greater impact on customers, revenue, and reputation.

“Cyber criminals are exploring ways to use new technologies such as generative artificial intelligence (AI) to automate and accelerate attacks, creating more effective malware and phishing. The growing number of incidents caused by poor cyber security, in mobile devices in particular, a shortage of millions of cyber security professionals, and the threat facing smaller companies because of their reliance on IT outsourcing are also expected to drive cyber activity in 2024, “explains Santho Mohapeloa, Cyber Insurance Expert, Allianz Commercial.

In addition to cyber incidents, financial services respondents also highlighted macroeconomic developments factors such as inflation, which is one of the most difficult risks to manage in 2024. The impact of inflation can have long-term consequences, with investments taking a while to regain value even after the economy seemingly recovers. Furthermore, inflation triggers higher interest rates, which increases net interest income but slows down loan demand and brings a higher default risk.

Compliance ranks as one of the biggest challenges for financial services companies, with legislation and regulation constantly evolving around digitization, climate change, and environmental, social, and governance (ESG) issues. The compliance burden for financial institutions has significantly increased over the past decade, with regulatory enforcement intensifying. To navigate these challenges, financial institutions must improve the effectiveness and efficiency of their compliance activities and make wise use of data and technology.

Business interruption poses significant risks to the financial services industry, including disruptions to operations, loss of revenue, reputational damage, and regulatory compliance challenges. Cyber incidents and natural catastrophes are the top two causes of business interruption feared most by companies, followed by fire and machinery/equipment breakdown or failure. To mitigate these risks, companies must focus on improving business continuity management, identifying supply chain bottlenecks, and developing alternative suppliers.

Natural catastrophes present significant risks to the financial services industry, including physical damage to infrastructure, disruption of operations, increased insurance claims, and potential liquidity challenges. The financial implications of natural disasters were underscored by the USD 82 billion [1]in insured losses globally in 2021. To effectively manage these risks, financial institutions must prioritize robust risk modeling, diversification strategies, and disaster preparedness measures.

The Allianz Risk Barometer serves as a valuable tool for financial services companies to identify and address the most pressing risks they face. By understanding these risks and implementing proactive risk management strategies, companies can safeguard their operations, protect their customers, and maintain financial stability in an increasingly volatile global business environment.

View the Allianz Risk Barometer methodology and full global and country risk rankings

About the Allianz Risk Barometer

The Allianz Risk Barometer is an annual business risk ranking compiled by Allianz Group’s corporate insurer Allianz Commercial, together with other Allianz entities. It incorporates the views of 3,069 risk management experts in 92 countries and territories including CEOs, risk managers, brokers and insurance experts and is being published for the 13th time.

For further information please contact:Johannesburg: Lesiba SethogaTel. +27 112 147 948 | This email address is being protected from spambots. You need JavaScript enabled to view it.

Get new press articles by email

We submit and automate press releases distribution for a range of clients. Our platform brings in automation to 5 social media platforms with engaging hashtags. Our new platform The Pulse, allows premium PR Agencies to have access to our newsletter subscribers.

Latest from

- 7 Business Trends Your SME Can Leverage In 2026

- Sadilar Amplifies Visibility And Impact During Conference Season

- Future-ready Logistics- 5 Shifts TO Watch In 2026 (SUB-saharan Africa)

- Dunlop Urges Motorists To Prioritise Tyre Safety On The Busy Joburg To Cape Town Festive Route

- Poverty Trends Report Shows National Progress But Flags Growing Challenges In Gauteng

- SDG Challenge SA 2025 Highlights The Power Of Youth Innovation In Shaping A Sustainable Future

- Experienced Industry Leader Pauli Van Dyk Named Dean Of AFDA’s Upcoming Hatfield Campus

- South Africans Keep Tourism Alive As Homegrown Travel And Local Spending Rise

- Pretoria Student Wins Global Excel Esports Competition

- AfDB Steps Up Support For Somalia With $76m Investment In Roads And Regional Integration

- Corporate Law Experts Warn Directors Of Serious Consequences For Improper Transaction Approval

- New 3% Inflation Target Begins To Shift Expectations In South African Economy

- Retail As A Development Catalyst Drives New Africa Developments’ Inclusive Growth Strategy

- Collaborative SEF Model Shows How Civil Society And State Can Rebuild Economic Trust

- Shumani Accelerates Industrial Growth With Bheka Forklifts And New Equipment Plans For 2026

The Pulse Latest Articles

- Education Is The Frontline Of Inequality, Business Must Show Up (December 11, 2025)

- When The Purple Profile Pictures Fade, The Real Work Begins (December 11, 2025)

- Dear Santa, Please Skip The Socks This Year (December 10, 2025)

- Brandtech+ Has 100 Global Creative Roles For South African Talent (December 9, 2025)

- The Woman Behind Bertie: Michelle’s Journey To Cape Town’s Beloved Mobile Café (December 9, 2025)