Getting to grips with cancer and the financial pitfalls of treatment

Written by: Teresa Settas Save to Instapaper

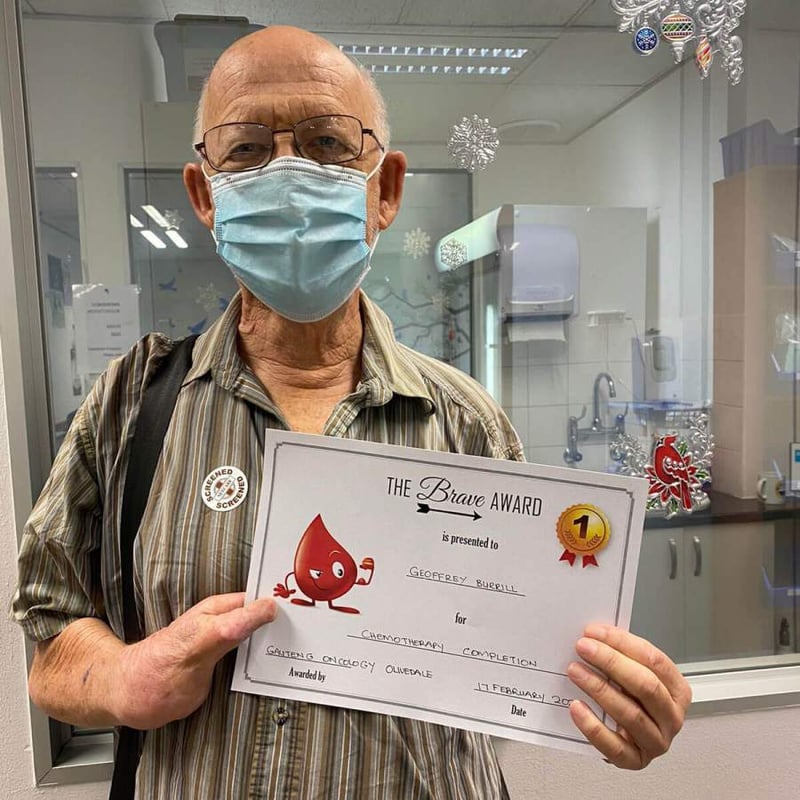

Nothing quite prepares you for hearing the words: “You have cancer”. For Geoffrey Burrill, hearing those words in June 2020 came as a complete shock, after what he thought was a bladder infection turned out to be aggressive bladder cancer.

At the time, Geoffrey had been on antibiotic treatment for what was initially diagnosed to be a bladder infection. But a few weeks in and two repeat prescriptions later, there was still no improvement. At this stage there was no pain or sign that anything was untoward, however Geoffrey’s GP referred him to a urologist for further investigation. Many tests followed. “When I returned for the test results and the urologist told me I had bladder cancer, and that it was aggressive, it felt like I had been punched in the face,” explains Geoffrey.

“I was given three days to make a decision on what treatment course to follow. We opted for intensive chemotherapy with the hope that I could avoid having a bladder removal, which would have huge implications for my quality of life. I also realised that I would not be able to work during my treatment, and as a self-employed contractor, this added tremendously to the stress of the whole situation. Going through chemo and having your immune system wiped out in the middle of a pandemic meant that my wife and I spent much of the last 12 months in isolation at home to avoid any risk of infection. I had employees who ran with the day-to-day work of my business, but the client dynamic and bringing in new business sat squarely with me. Money is the last thing you want to worry about in a health crisis, but the reality is that the treatment you can afford is fundamentally linked to the outcomes you can hope for,” adds Geoffrey.

The Burrills had comprehensive medical aid and Geoffrey’s cancer was defined as a prescribed minimum benefit (PMB), so he was covered for the cost of the cancer treatment under the oncology benefits. However, what they quickly realised was that the many diagnostic tests to confirm the cancer and staging – such as PET scans, sonars, blood tests and the many visits to specialist physicians and oncologists – would quickly wipe out their annual medical savings allowance for day-to-day medical needs – leaving them with a big financial shortfall that they would have to self-fund. It was here that their comprehensive gap cover policy with Sirago Underwriting Managerswould prove invaluable. Sirago’s Comprehensive gap cover option provides for an ‘Initial CancerDiagnosis’ benefit that pays a lump sum of cash upon the initial diagnosis of malignant cancer. This lump sum immediately went towards recouping the upfront costs and co-payments related to Geoff’s cancer diagnosis.

Costs are incurred even before cancer diagnosis

Martin Rimmer, CEO of Sirago Underwriting Mangers, a Gap Insurance provider underwritten by GENRIC Insurance Companyexplains: “What many people don’t consider is that diagnosing suspected cancer may involve expensive diagnostic tests which medical schemes may impose co-payments or sub-limits on, costing you thousands of unbudgeted cash upfront. That’s where a benefit like an ‘Initial Cancer Diagnosis’ lump sum on your gap cover is invaluable.”

Geoffrey’s treatment followed six cycles of intensive chemotherapy, and while the oncology benefit of their medical scheme option covered the majority of the treatment, there were numerous other shortfalls and co-payments that the Burrills faced. Fortunately, with the gap cover in place alongside their medical aid, they were able to reduce the direct financial impact to their pocket to a minimum. A year later, Geoffrey got the good news that he is clear of the cancer and was able to avoid the invasive and life changing option of bladder removal.

“Obviously this is a massive relief and what you absolutely hope for. Recovering from the severe side effects of chemo is the next big hurdle as I have lost my sense of balance and have damage to my nerve endings, leaving me with no feeling in my hands and fingers. Now we’re staring down the ongoing medical costs for the treatment of side effects that no-one tells you about at the start of your cancer journey,” says Geoffrey.

“One of the biggest lessons you take away from an experience like this is the importance of your healthcare financial planning, and the complex interplay between your health and finances. You need a solid healthcare financial plan with medical aid and gap cover to take care of your medical costs, you need a plan to protect your income if you ‘re unable to earn a salary for months on end, and you need liquid savings to deal with the many lifestyle changes you will need to make. And there’s undoubtedly an impact on your retirement planning if you’re forced to delve into your life savings.”

How to survive the financial challenges

While medical schemes typically cover the cost of certain cancer treatments as a Prescribed Minimum Benefits (PMB’s), depending on what option you are on, your costs of treatment might not be covered in full and you could face onerous out-of-pocket expenses, co-payments and shortfalls. Certain medical schemes might also only fund certain treatments partially like biologicals, if at all. If it’s a matter of life and death and you need these treatments, some medical schemes will allow you to upgrade your option immediately, but in the instances where you are not able to upgrade and your medical scheme options does not allow for the appropriate cover, you could be forced to sacrifice your life savings or future financial security to gain access to these treatments.

“Medical scheme options typically fund cancer treatment in one of two ways – either up to a certain annual limitor up to a certain Rand value for the entire treatment. Once these limits are reached, large co-payments of up to 20% are incurred on any ongoing treatment. Sirago has various gap options which provide additional cancer benefits catering for these Cancer Co-payments once your medical scheme cancer benefit has been reached and treatment co-payments are applied, including those related to biological drugs. Depending on your Sirago gap cover option, these co-payment benefits are limited to the available Overall Annual Limit available on your option. In some instances, when the medical scheme has a rand amount limit for their cancer benefits, certain Sirago gap options make provision for an annual Hospital Booster benefit, providing for an additional R100 000 (option dependent) per beneficiary, per annum. The trigger for any cancer benefit from your gap cover policy is that the member must belong and participate on the registered treatment plan as determined by their medical scheme,” adds Martin.

Get a well-rounded healthcare funding plan

Before taking any decisions regarding your purchasing of a medical scheme and or a gap option, always consult and talk to an accredited financial services advisor in order to put together a well-rounded healthcare funding plan to carry you through a possible health crisis, thereby ensuring that your only concern is your return to health when and if it happens. “Make sure that your healthcare funding such as medical scheme benefits and gap insurance work hand-in-glove to provide you with access to the best quality healthcare and treatment in order to mitigate as far as possible the need to delve into your monthly disposable income or life savings,” concludes Martin.

For more information go to www.sirago.co.za

Information provided is general in nature and does not constitute financial advice. Sirago Underwriting Managers (Pty) Ltd (FSP 4710), a gap insurance provider underwritten by GENRIC Insurance Company Limited (FSP 43638), an authorised Financial Services Provider and registered Short-term insurer.

Latest from

- Property and Cyber Risks for SMEs

- Privacy check-in – POPIA pitfalls in the hospitality industry

- The digitisation of payments in South African agribusiness

- AI vs Humans - Aon South Africa

- Changes on the Horizon for ESG Disclosures in South Africa

- Dewald Erasmus has been appointed as Head of Finance of MetroFibre

- Cyber security is an organisational responsibility given the threats posed by AI

- Customer Loyalty - From mass media to minutiae, from reach to reaching out

- Webber Wentzel launches a dedicated mentorship programme for its Candidate Attorneys

- New Competition Laws will impact businesses

- Priyesh Daya appointed as a member of the prestigious ICC International Court of Arbitration

- Webber Wentzel's rising stars recognised

- Unpacking the B-BBEE Scorecard - Preferential Procurement

- The Rise of Alternative Risk Financing Solutions

- EQ - The Most Powerful Skill for Customer Service

The Pulse Latest Articles

- Hansgrohe Reinvents The Washbasin With Avalegra (August 15, 2025)

- From Tiktok To The Karoo: New SA Initiative Reclaims Manhood Through Wilderness (August 14, 2025)

- Rode Report Expands Coverage To Include Multifamily Rental Housing (August 13, 2025)

- How Women At Steinmüller Africa Are Reshaping Industry Leadership (August 13, 2025)

- Ditch The Crash: 3 Smarter Drink Choices To Fuel Your Workday (August 13, 2025)