Prepare Now For The Carbon Tax Bill Or Face Hefty Fines

Written by: IWC Save to Instapaper

MARCH 2016 - To avoid massive financial penalties, South Africa-based industries need to immediately prepare for the implementation of the Carbon Tax Bill, warns Roger Rusch, CEO of IWC (Industrial Water Cooling).

In November 2015, the National Treasury published the Draft Carbon Tax Bill for public comment. Once implemented, the Bill will penalise companies with excessive Green House Gas (GHG) emissions, with the aim of changing the behaviour of companies by motivating them to shift towards cleaner, more energy-efficient technology.

This is a revolutionary step for South Africa, and forms part of the country’s commitment to reduce GHG emissions by 34% by 2020 and by 42% by 2025, as part of international guidelines set by the United Nations.

As outlined in the Draft Bill, the initial marginal carbon tax rate will be R120 per tonne of CO2e (carbon dioxide equivalent). Taking into account the thresholds mentioned below, the effective tax rate is much lower and ranges between R6 and R48 per tonne.

To allow companies to adapt and transition to low carbon alternatives in the first phase, a basic percentage-based threshold of 60% will apply, below which tax is not payable. The following additional tax-free allowances will apply:

o An additional 10% for process emissions;

o An additional allowance for trade exposed sectors, to a maximum of 10%;

o An additional allowance of up to 5% based on performance against emissions intensity benchmarks. These benchmarks will be developed in due course.

o A carbon offset allowance of 5 to 10%, depending on sector;

o And finally, an additional 5% tax-free allowance for companies participating in phase 1 of the carbon budgeting system.

o The combined effect of all of the above tax-free thresholds will be capped at 95%.

o Due to the complexity of emissions measurement in the waste and land use sectors, 100% thresholds have been set i.e. these sectors are excluded from the tax base for phase 1.

o The tax base comprises emissions from fossil fuel combustion, emissions from industrial process and product use and fugitive emissions.

o The greenhouse gases covered include carbon dioxide, methane, nitrous oxide, perfluorocarbons, hydrofluorocarbons and sulphur hexafluoride.

o Carbon tax on liquid fuels (petrol and diesel) will be imposed at source, as an addition to the current fuel taxes.

o For taxation on stationary emissions, reporting thresholds will be determined by source category as stipulated in the National Environmental Air Quality Act. Only entities with a thermal capacity of around 10MW will be subject to the tax in the first phase. This threshold is in line with the proposed DEA (Department of Environmental Affairs) GHG emissions reporting regulation requirements and the Department of Energy (DoE) energy management plan reporting.

The carbon tax will be administered by the South African Revenue Service (SARS) and companies will need to undertake appropriate national actions to curb greenhouse gas emissions by 34% by 2020 and a further 42% by 2025.

Company focus should not be on the "end-of-pipe" emission, but rather on the analysis of the production process and pollution prevention through improvements of production techniques.

The ‘Polluter Pays’ principle will apply because carbon pollution is a negative externality and therefore the costs are imposed on the whole of society. Those who cause environmental costs will be made to pay the full social cost of their actions.

Comments Rusch, “Although the Carbon Tax Bill is still in draft phase, there’s no doubt that it will be passed. All that remains now is for the Minister of Finance to determine the final tax rate, exemptions and the actual date of implementation. This means that companies with high GHG emissions, such as smelter plants, chemical production plants, boiler rooms, sulphur and coal burning power plants to name a few, need to start cleaning up their acts by finding cost-effective solutions to reduce their environmental footprints.”

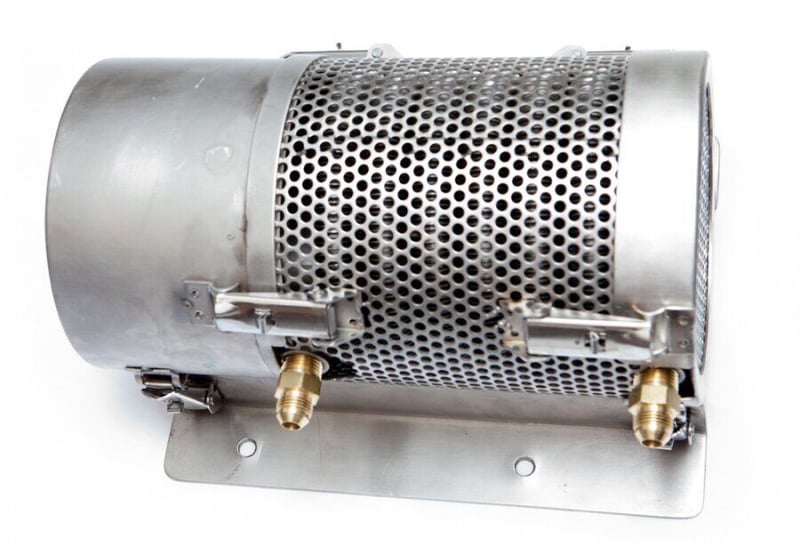

One effective approach to controlling and eliminating GHG emissions is by installing a scrubber plant inside the facility, suggests Rusch.

Scrubber plants are designed to capture pollutants such as carbon dioxide at source. GHGs are then either redirected to an underground storage facility or reused in the manufacturing process.

Says Rusch, “Scrubbers are the international industry standard for treating greenhouse gases at source. They will not only prevent companies from paying carbon tax penalties, but will also prevent costly treatment and rehabilitation of water and ground resources, fauna and flora, etc.

One of the most important factors companies will need to consider when installing a scrubber is choosing the correct material to use for the components inside the plant. In this aggressive chemical environment, companies should consider using GRP (glass-fibre reinforced plastic) components.

GRP is exceptionally durable, resistant to galvanic and electrolytic corrosion and can withstand continuous contact with aggressive compounds. All necessary scrubber equipment such as piping, ducting, fans, scrubbers, process vessels, chimney stacks, custom fabrications, bund walls and related fittings can be constructed out of GRP. IWC is geared up to provide customised reinforced fiberglass components across all industries.”

MdARCH 2016 - To avoid massive financial penalties, South Africa-based industries need to immediately prepare for the implementation of the Carbon Tax Bill, warns Roger Rusch, CEO of IWC (Industrial Water Cooling).

In November 2015, the National Treasury published the Draft Carbon Tax Bill for public comment. Once implemented, the Bill will penalise companies with excessive Green House Gas (GHG) emissions, with the aim of changing the behaviour of companies by motivating them to shift towards cleaner, more energy-efficient technology.

This is a revolutionary step for South Africa, and forms part of the country’s commitment to reduce GHG emissions by 34% by 2020 and by 42% by 2025, as part of international guidelines set by the United Nations.

As outlined in the Draft Bill, the initial marginal carbon tax rate will be R120 per tonne of CO2e (carbon dioxide equivalent). Taking into account the thresholds mentioned below, the effective tax rate is much lower and ranges between R6 and R48 per tonne.

To allow companies to adapt and transition to low carbon alternatives in the first phase, a basic percentage-based threshold of 60% will apply, below which tax is not payable.

The following additional tax-free allowances will apply:

- An additional 10% for process emissions;- An additional allowance for trade exposed sectors, to a maximum of 10%;- An additional allowance of up to 5% based on performance against emissions intensity benchmarks. These benchmarks will be developed in due course.- A carbon offset allowance of 5 to 10%, depending on sector;- And finally, an additional 5% tax-free allowance for companies participating in phase 1 of the carbon budgeting system.- The combined effect of all of the above tax-free thresholds will be capped at 95%.- Due to the complexity of emissions measurement in the waste and land use sectors, 100% thresholds have been set i.e. these sectors are excluded from the tax base for phase 1.- The tax base comprises emissions from fossil fuel combustion, emissions from industrial process and product use and fugitive emissions.- The greenhouse gases covered include carbon dioxide, methane, nitrous oxide, perfluorocarbons, hydrofluorocarbons and sulphur hexafluoride.- Carbon tax on liquid fuels (petrol and diesel) will be imposed at source, as an addition to the current fuel taxes.- For taxation on stationary emissions, reporting thresholds will be determined by source category as stipulated in the National Environmental Air Quality Act. Only entities with a thermal capacity of around 10MW will be subject to the tax in the first phase. This threshold is in line with the proposed DEA (Department of Environmental Affairs) GHG emissions reporting regulation requirements and the Department of Energy (DoE) energy management plan reporting.

The carbon tax will be administered by the South African Revenue Service (SARS) and companies will need to undertake appropriate national actions to curb greenhouse gas emissions by 34% by 2020 and a further 42% by 2025.

Company focus should not be on the "end-of-pipe" emission, but rather on the analysis of the production process and pollution prevention through improvements of production techniques.

The ‘Polluter Pays’ principle will apply because carbon pollution is a negative externality and therefore the costs are imposed on the whole of society. Those who cause environmental costs will be made to pay the full social cost of their actions.

Comments Rusch, “Although the Carbon Tax Bill is still in draft phase, there’s no doubt that it will be passed. All that remains now is for the Minister of Finance to determine the final tax rate, exemptions and the actual date of implementation. This means that companies with high GHG emissions, such as smelter plants, chemical production plants, boiler rooms, sulphur and coal burning power plants to name a few, need to start cleaning up their acts by finding cost-effective solutions to reduce their environmental footprints.”

One effective approach to controlling and eliminating GHG emissions is by installing a scrubber plant inside the facility, suggests Rusch.

Scrubber plants are designed to capture pollutants such as carbon dioxide at source. GHGs are then either redirected to an underground storage facility or reused in the manufacturing process.

Says Rusch, “Scrubbers are the international industry standard for treating greenhouse gases at source. They will not only prevent companies from paying carbon tax penalties, but will also prevent costly treatment and rehabilitation of water and ground resources, fauna and flora, etc.

One of the most important factors companies will need to consider when installing a scrubber is choosing the correct material to use for the components inside the plant. In this aggressive chemical environment, companies should consider using GRP (glass-fibre reinforced plastic) components.

GRP is exceptionally durable, resistant to galvanic and electrolytic corrosion and can withstand continuous contact with aggressive compounds. All necessary scrubber equipment such as piping, ducting, fans, scrubbers, process vessels, chimney stacks, custom fabrications, bund walls and related fittings can be constructed out of GRP. IWC is geared up to provide customised reinforced fiberglass components across all industries.”

Get new press articles by email

5 Press Release Articles

IWC, originally founded in 1986 as Industrial Water Cooling, are the leaders in industrial cooling systems in Africa, offering fully integrated solutions, from industrial cooling towers to GRP.

The Pulse Latest Articles

- Education Is The Frontline Of Inequality, Business Must Show Up (December 11, 2025)

- When The Purple Profile Pictures Fade, The Real Work Begins (December 11, 2025)

- Dear Santa, Please Skip The Socks This Year (December 10, 2025)

- Brandtech+ Has 100 Global Creative Roles For South African Talent (December 9, 2025)

- The Woman Behind Bertie: Michelle’s Journey To Cape Town’s Beloved Mobile Café (December 9, 2025)