How the increase in average wages can stall the interest rate’s current decline

Written by: Jesse Save to Instapaper

Economists use a lot of models, measures and statistics to predict interest rate movements. Using job data, and more specifically average salaries across South Africa, one can try to preempt whether the reserve bank will increase, lower, or leave the interest rate intact.

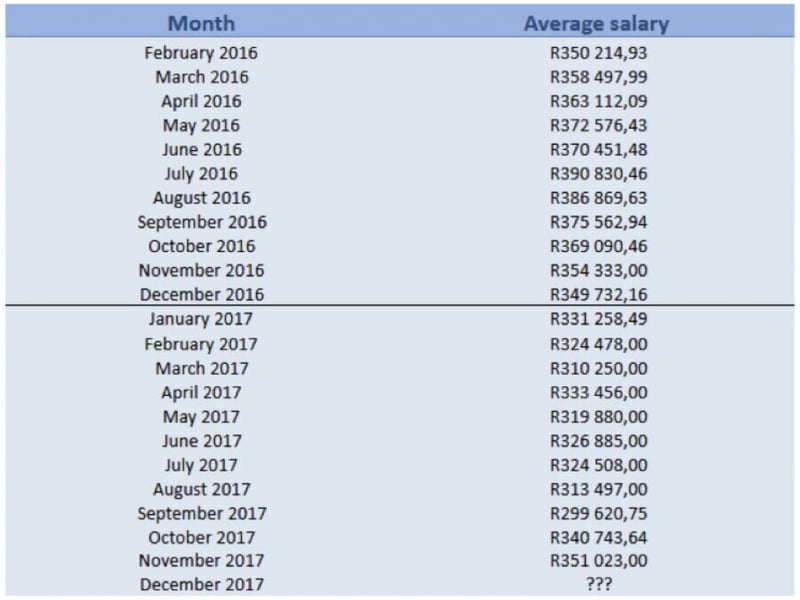

A lot has been said over the past few months about how the interest rate is bound to decline by January 2018, but with the continuous rise in average salaries that Adzuna, an online job aggregator picked up, that decline might well be stalled.

When people have more disposable income (when salaries are increasing), buying behavior increases, which in turn drives prices up and increases inflation. When salaries drop, consumers are left with less disposable income, which leads to a decrease in buying, a drop in prices, and a decrease in inflation. Since the average salary has been rising over the past few months (which few people saw coming), it only seems logical to argue that an interest rate decline will not occur, and that it may very well do the opposite under the pressures of the reserve bank.

Adzuna tracked movements in the average salary for over 140,000 online jobs. These indicators gave them a general idea of the average household income, which could impact inflation. Not all jobs are posted online, which could impact projections.

But while Adzuna lists over 140,000 mainly white collar vacancies, BankservAfrica’s Disposable Salaries Index (BDSI), which includes earnings from different sources, also revealed that despite South Africa’s ‘junk’ status, salaries are growing at the fastest rate since 2015. In July, the average recorded salary was at R14,154, which is a steady increase from the R13,894 it was on in June 2017. The report also indicated that average salaries were increasing faster than the rate of inflation, for five months in a row.

What this means is that although some people might predict a decline in the interest rate (compared to the 6% it was on earlier in 2017) average salaries are still increasing. As you can see from this graph, average salaries are increasing, even for jobs that aren’t advertised online. According to the latest data, South Africa saw a rise in consumer prices which was 4.8 percent higher year-on-year in October 2017.

That figure matched market consensus and eased from a 5.1 percent increase in September.

As far as Adzuna’s predictions for the next Reserve Bank decision go, it points to a future rise in inflation, unlike what many predictors out there are saying. There might be a lot of other factors which could impact the movement of the interest rate, but job and salary data aren’t currently indicating a drop.

If anything, inflation rates in South Africa will be on hold until at least after the February budget. When you take Adzuna and BankServ’s data into account over twelve months, the figures might not indicate a definite increase in inflation, but as long as average salaries keep rising, inflation is bound to move upward and interest rates downward. Thus, in closing, it will be surprising to see the interest rate drop over December or early 2018, and it is more likely to see it remain stable.

Get new press articles by email

7 Press Release Articles

--

The Pulse Latest Articles

- Education Is The Frontline Of Inequality, Business Must Show Up (December 11, 2025)

- When The Purple Profile Pictures Fade, The Real Work Begins (December 11, 2025)

- Dear Santa, Please Skip The Socks This Year (December 10, 2025)

- Brandtech+ Has 100 Global Creative Roles For South African Talent (December 9, 2025)

- The Woman Behind Bertie: Michelle’s Journey To Cape Town’s Beloved Mobile Café (December 9, 2025)