Cryptocurrency minig with Spelo Sinekelo

Spelo sinekelo was born in April 3rd, 1998 at North West, Klerksdorp in Tshepong hospital. At the age of 11 years old his mother died due to natural cause. Him and his sister were forced to move to eastern cape they had no one to take care of them, they were taken care of by the family called Mcinga at Eastern Cape, butterworth.

He studied at khulile junior secretary school and passed to pakamani senior secondary school where he passed with bachelor pass symbol. Today he’s doing his third year at University of fort hare in education as a foundation phase teacher.

During his first year Spelo had a difficulties financially, he wanted ways to earn money while he was studying for his degree. He learned on how to trade foreign exchange market also known as (forex), he was earning money on forex but it was disturbing his studies, he was focused on charts analysis than studying.

One day he received a call from sivilenathi dwangu from port Elizabeth, sivilenathi introduced Spelo to cryptocurrency, how it works and how you can earn passive income from it. He introduced Spelo to a mining company called Mining city that mines bitcoin,bitcoin vault and electric cash. since that day Spelo had a financial freedom he made passive income on cryptocurrency mining and network marketing.

Spelo Sinekelo is about to publish his first book Titled “Do Yourself A Favour” where he talks about financial freedom

CURRENT SA MARKETS - Time to throw in the towel, or should we hold out for a hero?

Questions that are most probably top of mind for a multitude of foreign investors is ‘Why South Africa and why now?’, and one could be forgiven for being unsure as to the answer.

It is no secret that the South African markets have been in a state of flux. In his first SONA last year, Cyril Ramaphosa promised “a major push this year to encourage significant investment in the economy”. Pivotal to this push, foreign investment from firms and individual investors outside of our borders was necessary. But, taking into account the dismal financial results reported by Moody’s in Q1 2019, will President Ramaphosa be able to make the necessary changes and reforms to help economic growth accelerate to as high as 3% by 2022?

According to the group, in a macro-analysis released at the beginning of June 2019, the odds that South Africa may experience a technical recession are high. This, in a large part, can be contributed to the widespread power outages experienced so far in 2019 that have had substantial negative ripple-effects, particularly for the mining and manufacturing sectors.

The task of resuscitating South Africa’s economy is certainly an onerous one, with the reality being that now is the time to dig deep as a country and harness all available resources. But it isn’t all doom and gloom on the investment front. With the recent ANC election win, under the leadership of Ramaphosa, hopes are high for renewed reforms that could potentially tackle the unemployment rates and provide a re-energised push to ignite growth.

Whilst financial markets are generally positive towards South Africa at the moment, an underlying sentiment that seems to be weighing on investors is whether government can effectively address the Eskom issue. After more than a decade of increasingly slow growth, and an exponential rise in joblessness, immediate policy priorities from Ramaphosa are a crucial first step to addressing South Africa’s complex economic challenges.

So, the question still remains – Why South Africa and Why Now?

The outcome of the election has been in line with market expectations and sentiment towards South African markets remains tentatively positive. The announcement of a drastically smaller, reshuffled cabinet this month is also bound to alter our economic course. Add to that Moody’s decision to skip the much-anticipated assessment of SA’s sovereign credit rating until November 2019, and it seems that for now, South African markets have been granted a reprieve, albeit a small one.

The Rand is expected to weaken over the next few weeks both in terms of the USD and the Pound rate, but the dominant position of the South African economy on the African continent, and the liquidity of the Rand on international markets still make the ZAR the currency of choice for investors seeking African exposure.

Although things look precarious, investors shouldn’t throw in the towel just yet. A look at analysts’ consensus forecasts (according to Thomson Reuters) on individual shares (based only on price forecasts, i.e. excluding dividends and adjusted according to their weight in the index) in the FTSE/JSE Top40, shows that analysts still expect the Top40 Index to be trading 21.6% higher from current levels (48 465 as at 28 May 2019).

As the famous John Templeton said, “Bull markets are born on pessimism, grown on scepticism, mature on optimism, and die on euphoria. The time of maximum pessimism is often the best time to buy, and the time of maximum optimism is often the best time to sell.”

Sources:

https://businesstech.co.za/news/finance/321905/high-chance-of-recession-in-south-africa-moodys/

https://www.fin24.com/Economy/moodys-delay-is-good-news-for-the-rand-say-analysts-20190330-2

https://www.moneyweb.co.za/news/economy/the-rand-isnt-sas-share-price-anymore/

https://www.fin24.com/Finweek/Investment/is-now-the-right-time-to-sell-your-shares-20190605

SA gets it’s very first LGBT owned Cannabis Emporium within 24 hours after legalization on Thursday 24 May 2019

Telling your mom you’re going to the CBD has an sinister new meaning from today (Friday 24 May 2019) after the latest victory in Dagga Wars... Cannabidiol (CBD), a compound extracted from cannabis that is found in everyday items such as skin creams, body oils and even beer, is suddenly the new buzzword in South Africa after the legal status of CBD got the green light on Friday.

The long and the short of it is that certain “medicinal” dagga products – Cannabidiol, or CBD, or dagga oil, to be exact – may now be sold without prescription. CBD is accepted as not being psychoactive. The oils containing this element are also NOT habit-forming and CBD does not pose any dangerous side-effect as long as the daily dose does not exceed 20 milligrams.

Also, the minister of health, Aaron Motsoaledi, announced that marketers are not allowed to claim their products Can cure or treat any medical condition. However, it is widely accepted that cannabidiol has an extremely positive affect on people suffering from anxiety and sleeplessness to chronic pain from arthritis. Apparently, it even helps with seizures.

CBD is immediately available from Vondel Premium (PTY) Ltd., an online concern based in Gauteng (see www.vondel.co.za). Vondel.co.za hosts an array of resources – from an intricate look into the medicinal benefits of CBD to the curing process of cannabis. “CBD products are notoriously expensive across the globe,” says co-founder Rian Kotze. “Vondel aims to limit margins in order to maintain pricing that is fair and more easily accessible to the general public. This is beneficial not only to the general public but might also seem appealing to interested investors looking to pair up with an early stage market disruptor.”

Products can be ordered online at www.vondel.co.za (payments are processed by PayPal) and delivery will take between 4 – 6 working days. This will soon reduce to 2-day deliveries as Vondel plans its own logistics solutions. According to co-founder and LGBT activist Jeandre Verster, Vondel is currently preparing for Series-A funding from potential Angel Investors. The company hopes to launch its first retail location by the end of the year, as well as develop their own range of CBD and related Cannabis Pharmaceuticals in preparation for full legalization coming 2020.

Interested investors can make contact via This email address is being protected from spambots. You need JavaScript enabled to view it. Vondel also boasts a rather impressive Charity Policy, dedicating a staggering 20% of nett profit to Parkinson’s and Elder Relief organizations. ENDS Issued by www.vondel.co.za. Visit the website for more information.

THERE HAS NEVER BEEN A BETTER TIME TO GEAR UP YOUR INVESTMENTS ON THE ONLINE INFOBAHN

Online trading. A concept that has literally thrust the financial world into the fast lane. But for most armchair investors putting the pedal to the metal to get in on the action of this online infobahn can seem extremely daunting, and without some expert guidance many just get left behind in the pits. With the right tools and support everyone can become a successful trader, but it is also important to continually sustain entrepreneurial growth. With this in mind, CM Trading are running an unprecedented campaign that allows all Business Referrers who introduce new clients to the world of online trading the chance to win a stunning BMW Z4! Yes, you read that right! Just by being a business referrer you could be burning rubber in your very own, very exotic BMW Z4.

CM Trading, an award-winning online trading company is committed to providing an essential investment service to clients who prefer an out-of-the-box approach to investment opportunities. With so many vehicles for financial growth accessible to South African investors, making responsible choices that yield tangible returns requires sound expertise from a partner with a vested interest in your long-term success.

Getting your position on the grid

Knowing just where to start is key to your investment growth. “Although a vast majority of people are familiar with online trading, very few understand exactly where to begin the process”, says Daniel Kibel, Founder and Director of CM Trading. “We are here to rev up the engines in the market. To offer the guidance, tools and support that will become the driving force that not only gets average South African’s into the investment game, but could potentially change one of their lives with our awesome prize.”

Most of us believe that in order to effectively trade, one needs to be an expert with a large sum of investment capital. But this notion has been debunked with their development of new and unique software solutions; webinars, training videos and e-books – all for free. “It is important to understand that anyone can become a trader through our unique website and easy to use and understand portals,” says Kibel, ”You don’t have to be a trading genius or have years of experience as a stock broker – we have created the platform to allow you to do it yourself.”

Put both hands on the wheel and take control of your finances

It is important to remember that you are in the driver seat when it comes to the performance of your investments. It’s a hard pill to swallow, but there is simply no quick fix when it comes to making money. It’s up to you to ensure that you’re aware of the risks, mindful of the markets ebb and flow and ultimately make the most out of the opportunity that sound investing offers. When asked if online investing is a savvy financial move, the only advice that Kibel could provide was none. “We are not here to offer investment advice. Our role is to provide our clients with the very best education and tools possible so that each and every one of our traders fulfil their full potential and trade like a pro. It’s a fact that money in the bank provides absolutely no value yield. The return that one can make through online share trading is so much more than the interest rate that the banks will offer you (on a fixed deposit from the major South African banks, the average rate is between nine and ten percent). Responsible and expertly guided share trading can nett you so much more.”

Providing the driving force behind entrepreneurial growth

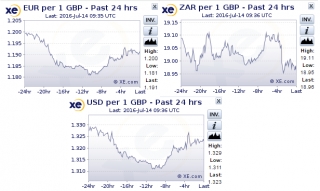

Online investment now truly is accessible to one and all. “This is an exciting time to invest. The markets are going wild with the Rand in its current state. Add to that the uncertainty surrounding Brexit, and the stage is set - with the market in a state of flux, one can be assured that there is money to be made”, concludes Kibel.

The crux of the matter is that when it comes to savvy investing, there is no checkered flag offering the sought-after podium finish. Constant warm up laps may be required; you may be forced to slow down and do an economy run every now and then; you will probably have to go up through the gears as you chase pole position… The only certainty is that the online trading circuit, and your navigation of it, is uncertain. It is essentially up to you to choose your team wisely. As the largest Forex broker in SA, and winners of the prestigious Best Performing Broker in Africa Award for the last three years, CM Trading provides a wealth of tools and resources at your fingertips because the better prepared you are, the better your trading performance will be.

To be a part of this incredible campaign to win a BMW Z4 visit www.cmtrading.com or email This email address is being protected from spambots. You need JavaScript enabled to view it..

Business Investment meeting to connect startups to funding.

One of the fears that wealthy people are grappling with is being part of the next big thing in the large scale of investments.

Property is highly saturated these days, the interest rate is making some investments unattractive and offshore savings are reeling off the issues of the economic downturn in some countries.Investment in startups seems to be one of the niche that is becoming an attractive topic in the investment arena. It gives rich people an opportunity to acquire as much equity in the next big ideas.

The first ever business investment event that actually connects companies to investment opportunities is launching on the 05th of July this year.The event gives 20 emerging companies the opportunity to showcase their idea to an audience mix of private and public investors.

The auction model allows investors the opportunity to indicate business they deem fit and would like to invest in. Invited to the event are business development specialist and analysts as well as successful business entrepreneurs to educate startups.Our angle is to engage crowdfunding corporations and access their investment database to give diversity to the investment pool. We invite private investment companies and extend invitations to government funding agencies to balance the chart. Finally, we structure a sponsorship plan that directly pays the most outstanding business at the meeting. These gives numerous opportunities to businesses with great ideas.

In order to increase the spectrum of the event and create awareness and support for South African business internationally. We do a business investment call with investment corporations who are willing to sponsor African businesses. We have 5 representatives from 5 international investment agencies in America, London, Canada, and Germany all attending this year event. The biggest in the list of invited investors is C5capital. The Investment engagement platform created by BIM to give international investors the opportunity would boost tourism and attract foreign Investors in the country.

We welcome all emerging industry leaders and market shifters who believe they have a great idea to be part of the inaugural event this year.Businesses and investors alike can register on the beta site reserved for the event at www.empowerproject.co.za to be part of the event.

A Boost for Business

Last week, (before he was replaced by Nhlanhla Nene), Ex-Finance Minister Malusi Gigaba gave the budget speech and announced some initiatives that seek to support Small, Medium and Micro Enterprises (SMMEs*) in SA.

In a sign of support for SMMEs, numerous measures have and will continue to be implemented. This includes a R2.1 billion allocation for SMMEs in the early start-up phase. An additional R1.4 billion from the CEO initiative will support high potential SMMEs, and public procurement regulations will be revised to improve dealings with government. A black business growth fund worth R100 billion will be made available to sponsor large deals - yet another exciting tool on the horizon for SMMEs.

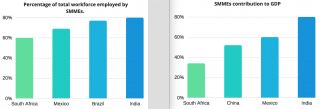

SMMEs are key for job creation and the development of an economy. In SA, they make-up 91% of formalised business in terms of company numbers and employ 60% of our labour force. In an OECD study, it was found that the bulk of jobs are created by companies with fewer than 250 employees - and the majority of those have less than 200 employees each. The chart below illustrates their findings across countries and shows that South Africa underutilises the SMMEs potential contribution. In terms of contribution to GDP, South Africa also falls short of other countries. This next chart illustrates how much SMMEs contribute to their respective countries' GDP.

Well, there are many, but access to financing is usually high on this list of obstacles for SMMEs. Considering the risks, banks are less willing to provide loans to unproven businesses, and if they do lend, they typically charge high-interest rates. The rural location of many informal SMMEs further intensifies this problem. Lack of access to infrastructure, utilities, transport and land all pile on more challenges. Whilst the journey is being made easier, a lot of work lays ahead. Growth in South African SMME numbers has been slow - research shows that the number of SMMEs only grew from 2.1 million to 2.2 million between 2008 and 2015. This doesn't bode well for the National Development Plan, which hoped that 90% of new jobs would be created by this sector by 2020.

Well, there are many, but access to financing is usually high on this list of obstacles for SMMEs. Considering the risks, banks are less willing to provide loans to unproven businesses, and if they do lend, they typically charge high-interest rates. The rural location of many informal SMMEs further intensifies this problem. Lack of access to infrastructure, utilities, transport and land all pile on more challenges. Whilst the journey is being made easier, a lot of work lays ahead.

The initiatives identified by treasury indicate a clear emphasis on the importance of SMMEs to the growth of the SA economy. The focus on increasing the sources of funding available bodes well for one of the major challenges. It’s important for government to focus on additional policies that meet most of the issues facing small businesses. Perhaps an important aspect relates to being able to develop and improve entrepreneurial skills and knowledge. We are interested to see how this develops.

__________

This article first appeared in Digest |@digestRSA | www.digest.web.za |

Digest is a free email newsletter delivered to our inbox weekday mornings explaining financial newsworthy topics and events.

Are you looking for a Plan B - for a safer and more secure future for your family?

Do you have a Plan B for a safe and secure future for your family?

Australia and the UK are Plan B's With Australia being very expensive and in the middle of nowhere..

And the UK being very expensive, with a cold, wet and miserable climate!...

We would like to introduce you to our Plan A... The Costa Del Sol region in Spain!

Voted the Best Lifestyle in Europe, and 1 of the most affordable!

If you have an EU Passport we can help you.

If you don't - we can assist you to get residency through Spain's Golden Visa program. Invest EU 500 000 into the property market, and qualify for residency.

For more info call Greig on 074 211 5670 or email This email address is being protected from spambots. You need JavaScript enabled to view it.

BREXIT and the African Sunset!

Theresa may was sworn in as Prime Minister of the UK and her opening speech resounded around the world and the British Pound recovered against the SA Rand and most currencies but was this just a blip.

So what does this mean to us in South Africa and what impact will this have on our struggling economy or Africa as a whole.

Well Boris Johnson was appointed UK foreign Minister

If you recall, The Africans For Britain Group, who supported the Brexit because the group had argued that Britain leaving the EU would encourage trade with African and Caribbean nations and make it easier for people from those countries to travel to the UK. So where are they now? And what is their response? Silence is deafening.

So can we expect the same see-saw or will the pound make a brief comeback as decisions get made and more UK announcements are made?

What is for certain is that we will see more announcements being made on trade in the African continent from both the EU and I suspect the UK changes will happen too.

Some analysts have stated that the Brexit would surely weaken trade ties between the U.K. and African countries and with their over 100 trade agreements this will result in lengthy processes, which could cause a decrease in trade volumes with the UK, but an increase in trade volumes with the EU.

We need to keep in mind that statistics from the UK’s Office for National Statistics and the United Nations Conference on Trade and Development for 2014, only 18 months back, it is calculated that exports from Africa to the UK represent about 5% of Africa’s total exports and that Africa is actually more worried about China’s slowdown, its biggest trading partner by far, than that of the UK. So Africa itself needs to focus on the EU as an export partner.

We know that the East African Community and the EU are due to sign an Economic Partnership Agreement in October and there are probably other agreements in the pipelines for countries. South Africa has the UK based agreements in the Mining and Financial sector but these are in themselves not self-sustaining and job creation which is what is needed, more likely they are self-gain based.

So financial the bet lies on the EU and Africa – we need to manage this and watch the growth and changes, if the UK makes a move the effect lies externally and not on us, we will flinch, but remain resilient.

By: Chris Green - Financial Entrepreneur

http://coronation.com/global

BREXIT & African Union relationships and future

Financial it seems that Brexit has created the possibility of some form of economic changes in Africa. The African Union (AU) leaders have met to analyse the impact of this event and of course look at ways toward an even bigger continental integration of the continent and ways to benefit from this momentous event. This would be from both parties, the EU and UK.

The issues facing Africa’s growth and recovery during this time are hugely influenced by the slowing down of China's economy (without a doubt the main bilateral trading party). Then we can see the US Fed raising interest rates and borrowing options become less favourable, the drought and El Nino and then finally prices of Africa’s main exports - mining, metals and oil have fallen with low demand and plenty supply.

So this definitely gives rise to rethinking policies and new strategies and approaches for 2016 and beyond.

So for South Africa, and the rest of Africa, but particularly SA, even with our politician’s having a short-term calendar because of elections, we need macro-economic management and keep on course for medium to long term policy management.

Starting with:

- Spending internal money through investments

- And in growing human capital and localised business

- Strengthen our non-mining and non-financial economies.

Trade with the Trans-Pacific Partnership (TPP) agreements from 2015 with countries which include the United States, Japan, Canada, Mexico, Australia, Vietnam, Malaysia, and Chile needs to be a key focus of leaders now.

Of course, the United States is constantly engaged with negotiations of trade with the European Union and as this will cover about 55 to 60 percent of global GDP – so as Africa is not involved here will the US share this with Africa and can this work. Or will Africa be ignored and be confined to a shrinking share of international trade and lose the appeal as a destination for investment? This is a big danger.

The attraction for the EU and the UK independently, however, lies in the fact that the Africa Union has committed to completing the African economies integration plan by 2017, which will result in 54 African countries representing more than a billion people and between R42 and R45 trillion Rands in GDP. So we could see an intra-Africa trade bouncing back by more than 50% within the next 5 to 6 years. Why would the EU and the UK not want a slice of that action?

In favour of the African Union, we know that EU has way more financial resources than the AU and that the AU’s budget amounts to about 1 percent of the EU’s, however, even though the AU does not have the money they have a population of over a 1,050 million people—double that of the EU.

Africa has a young and dynamic workforce, with the average age of 20 making up 20% of the region’s total population – that needs harvesting!

By: Chris Green - Financial Entrepreneur

This email address is being protected from spambots. You need JavaScript enabled to view it.

Is South Africa Worthy of Your Investment?

Developing countries like South Africa need FDI (Foreign direct investment). They are investments in a business by an investor from another country for which the foreign investor has control over the company purchased. The Organization of Economic Cooperation and Development (OECD) defines control as owning 10% or more of the business. Increased FDI in developing countries contributes to the country’s economic development because of external capital and increased revenue. This helps developing countries create employment opportunities for its citizens and invest in local skills development and new local industries.

The developing government is able to use the capital infusion and tax revenue generated from FDI for economic growth by improving the physical and economic infrastructure of the country. These include building roads, educational institutions, developing transport and communication systems and also subsidising the creation of domestic industries. The result is making it possible for all citizens to benefit from the FDI. Besides from the monetary aspect; FDI affords developing countries a learning experience which in turn leads to additional growth paths.

South Africa is currently losing Barclays bank, which owns Absa bank; as an investor. Major newspapers are reporting that the country’s wealthiest individuals are taking their money out of the country because they are weary of the country’s economic future. To top things up, according to the latest World Investment Report 2016 FDI into South Africa is sitting at $1.8 billion, the lowest in 10 years, owing to factors such as lacklustre economic performance, lower commodity prices and higher electricity costs.

Policy uncertainty by the government has a major part to play in the economic misfortune and lack of foreign investment confidence from Western industrialised countries which happen to be the country’s major source of FDI. South African households are extremely indebted while the government is short of funding both resulting in limited investment and domestic consumer growth. The future will only start looking brighter for South Africans once the country improves on domestic investments in the form of foreign direct investment.

According to risk analysts, South Africa has risk factors which prevent it from being a lucrative investment market which include the prevalence of white-collar crime and corruption and the increasingly inevitable outcome that South African bonds will be downgraded to “junk” status. Not to mention that South Africa is Africa’s most targeted region for cybercrime. Risk analysts also conclude that South Africa is still a good place to do business. There is plenty of slow and steady money to be made in the country. South Africa’s fundamentals are not as bad as they seem. If you are confident South Africa is worthy of your investment, click HERE for investment insights.